Stubborn

Andy Rothman provides four reasons why he’s stubbornly convinced that Xi Jinping will eventually overcome his stubbornness and make the changes necessary to put China back on track to reach its potential growth rate.

Key Takeaways

- At two recent meetings with his leadership team, Xi Jinping refused to fix problems preventing China’s economy from returning to a stronger growth rate.

- This is frustrating but in this Sinology I explain why I believe Xi will eventually overcome his stubbornness and take steps to restore confidence among entrepreneurs and consumers.

- It is impossible to predict when that will happen and we should be prepared for a long wait.

- In the meantime, the pace of economic growth will remain decent but uninspiring to investors at home and abroad.

At two recent meetings with his leadership team, Xi Jinping refused to acknowledge and fix problems which are preventing the Chinese economy from returning to a stronger growth rate.

This is frustrating but I believe that at some point, Xi will accept that to achieve his economic goals he must take steps to restore confidence among the country’s entrepreneurs and consumers. It is, however, impossible to predict when Xi will take these steps. We should be prepared to continue our frustratingly long wait.

In the meantime, the pace of economic growth will remain decent but uninspiring to investors at home and abroad, in my view. A crisis is not looming and China will likely continue to account for about one-fifth of global economic growth, a larger share than from the G-7 countries combined.

In this Sinology, I provide four reasons why I’m stubbornly convinced that Xi will eventually overcome his stubbornness and make the changes necessary to put China back on track to reach its potential growth rate.

- First, Xi presumably understands that entrepreneurs and consumers are the engine of China’s economic growth and that he must act to restore their confidence.

- Second, since last year, Xi has promoted an economic strategy focused on innovation which depends on entrepreneurs. Success in industries such as batteries and artificial intelligence (AI) requires a more supportive approach to the private sector.

- Third, Xi must recognize that failing to overcome his stubbornness to address the concerns of entrepreneurs and consumers may have negative consequences for social stability.

- Fourth, recently published second quarter macro data shows a clear deceleration in the pace of economic activity which should incentivize Xi to overcome his stubbornness and course correct.

Xi has often been stubborn before changing

Xi has often demonstrated that he can be obstinate, taking too long to change failed policies. His “zero-COVID” policies, for example, were very effective during the early phase of the pandemic but failed as new variants of the virus began to circulate. Xi stubbornly refused to change his approach to COVID, including at the 20th National Congress of China’s Communist Party in October 2022 despite strong public opposition and significant economic damage. Finally, a month after that meeting, he changed course and ended zero-COVID and reopened the economy.

Prior to that, in the summer of 2020, Xi’s government announced new residential property policies, referred to as “the three red lines,” which inadvertently tipped the housing market into recession. New home sales (on a square meter basis) fell 34% year-on-year (YoY) in 2022, then fell another 8% YoY in 2023, and dropped 24% YoY during the first four months of this year, before Xi finally announced policy changes on May 17.

Waiting a few years too long to fix the property problem caused house prices to fall, many developers to fail, and the loss of construction jobs as new home starts froze. These property policy failures have been a key factor behind the loss of confidence among consumers and entrepreneurs.

The May 17 policy changes are a good starting point, with Xi finally acknowledging the problem and committing to fix it. The initial response by the market was positive, as new home sales recovered slightly in June, compared to May, but implementation of the new policies must be ramped up quickly and effectively to restore confidence. Realistically, given the complexity and cost of the new policies, significant progress isn’t likely to be evident until well into next year.

Lack of confidence is the biggest problem

In my view, the key economic problem today is a collapse in confidence, both by entrepreneurs and consumers. Confidence among entrepreneurs has been weak for several years because of doubts about Xi’s support for the private sector and because of a series of regulatory policy changes which upended industries such as internet platforms, online gaming, for-profit education and real estate.

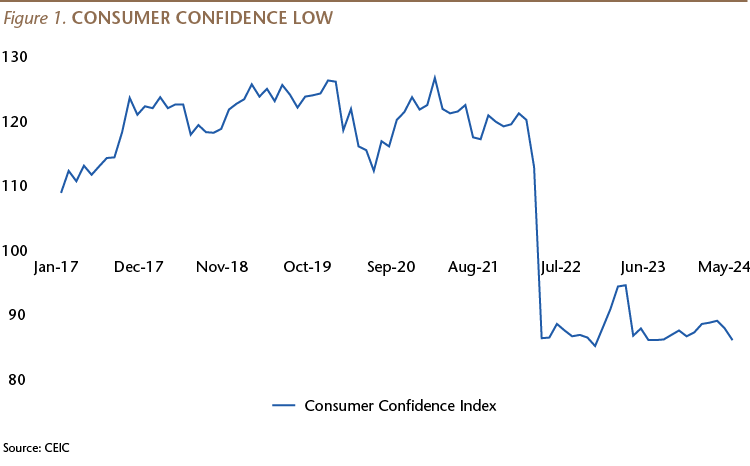

Consumer confidence was resilient in the face of that regulatory chaos but collapsed during the 2022 Shanghai COVID lockdown. More than two years after the lockdown and other zero-COVID policies were ended, consumer confidence—as measured by the Chinese government’s own survey— remains at historically low levels (Figure 1).

It is important to keep in mind that because the majority of urban consumers are either entrepreneurs or employees of small, privately-owned firms, restoring confidence among small companies—so that they invest in and hire for their businesses, which will lead to job and wage growth—is critical to rebuilding consumer confidence and spending.

Four reasons for continuing to expect change

Xi’s stubbornness is frustrating. But, as in the cases of COVID and property, I expect him to eventually push past his policy willfulness and make changes. I have four reasons for continuing to expect change, although there is no way to know when that will happen.

Reason one: domestic demand drives the economy

First, Xi should understand that entrepreneurs are the engine of China’s economic growth, the reason China has become wealthy, and the reason the Chinese Communist Party has remained in power for so long. Xi worked in some of China’s most entrepreneurial places during his long career and his late father, Xi Zhongxun, oversaw the early market-oriented reforms in Guangdong, from 1978 to 1980.

When I first worked in China in 1984, as a junior American diplomat, there were no private companies—everyone worked for the state. (Xi, during that time, was a Party secretary implementing reforms in a poor region of Hebei Province.) Today, almost 90% of urban employment is in small, privately owned, entrepreneurial firms.

The rise of China's private sector has continued under Xi. Since he became head of the Party in 2012, private firms have continued to drive all net, new job creation. Official media report that the private sector accounts for more than half of China’s tax revenue, more than 60% of its GDP, and more than 70% of the country’s technological innovations. Trade, too, is dominated by entrepreneurs. In the first half of 2024, exports by private firms accounted for 64% of the value of exports, up from a 38% share in 2012 and only 7% in 2001.

Xi should also understand the importance of domestic demand. Final consumption last year accounted for 83% of GDP growth, with net exports (the value of a country’s exports minus its imports) a negative drag on growth. In the five years before COVID, final consumption contributed 63% of GDP growth, while net exports contributed less than 2%. (The balance was gross capital formation.)

In the first half of this year, because of slower growth in household income and spending, final consumption accounted for a smaller share of GDP growth (61%), leaving net exports to take a larger share (14%). This is, of course, not sustainable, given the political opposition to the continued rise of imports from China in many major markets, especially the U.S.

Reason two: Xi’s new strategy depends on entrepreneurs

Second, since last year, Xi has promoted an economic strategy focused on “new-quality productive forces,” which depends on the success of China’s entrepreneurs. This strategy, Xi has said, depends on “disruptive technology . . . to give birth to new industries. . . that are characterized by high technology, high performance and high quality.”

To achieve this objective, Xi needs to rebuild confidence among the private sector which, officials have said, represents over 90% of China’s high-tech companies. For example, by our count, 13 of the 15 globally significant Chinese battery makers are privately owned; seven of the top 10 electric vehicle makers (by number of units produced), are privately owned; and all of the eight leading artificial intelligence (AI) startups are privately owned.

Reason three: future social stability concerns

Third, Xi must recognize that failing to overcome his stubbornness to address the concerns of entrepreneurs and consumers today may have negative consequences for social stability in the future.

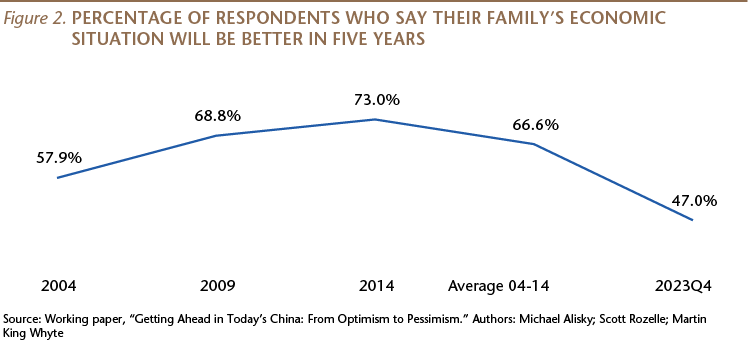

“Getting Ahead in Today’s China: From Optimism to Pessimism,” a new Stanford University working paper by Scott Rozelle, Martin King Whyte, and Michael Alisky, offers some sobering survey results, comparing current attitudes about family finances in China with results from surveys in 2004, 2009 and 2014.

In the three surveys conducted between 2004 and 2014, when asked why people in China are poor, the top response was “lack of ability” of those people. But, in the 2023 survey, the top response was “unequal opportunity,” which ranked fifth in the earlier surveys. Asked why people in China are rich, the top response in the 2004-2014 surveys was “ability and talent,” with “hard work” the second choice. Responses were very different in the 2023 survey, with “connections” the top answer, followed by “grew up in a rich family.” Ability and talent, and hard work, fell to number 4 and 5 in the ranking.

During the three surveys between 2004 and 2014, on average, 70% of respondents said their current family economic situation had improved compared to five years ago, but in the fourth quarter of 2023, only 39% said their economic situation had improved compared to five years ago. Expectations for the future also weakened. In 4Q23, 47% of respondents said they believed their family’s economic situation would be better in five years, down from an average of 67% in the earlier three surveys.

The authors conclude that the results “do not suggest that popular anger about the unfairness of current patterns of inequality is likely to explode in a social volcano of protest activity. They do suggest, however, that the performance legitimacy accumulated by the leadership through decades of sustained economic growth and improved living standards appears to be beginning to be undermined.”

Reason four: without change, Xi is unlikely to hit his economic targets

Fourth, recently published second quarter macro data shows a clear deceleration in the pace of economic activity, especially in consumption, the most important part of the economy. Absent policy changes which restore confidence enough to re-energize entrepreneurs to hire and invest, and consumers to spend, there is a high probability that GDP growth will continue to slow in the coming quarters, making it very difficult for Xi to achieve his growth targets. This should incentivize Xi to overcome his stubbornness and course correct.

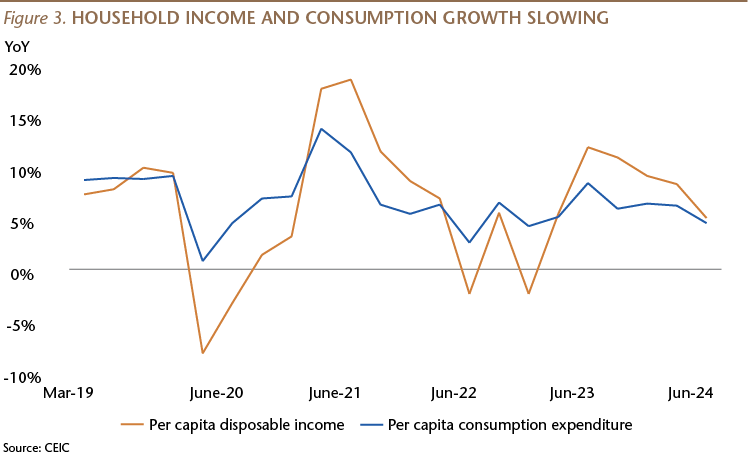

The second quarter deceleration was clear. Real (inflation-adjusted) per-capita household income rose 4.2% YoY in 2Q24, down from 6.2% in the first quarter and 8.3% a year ago. Income growth also slowed for the 190 million rural residents who work in urban manufacturing and services jobs. Income for these migrant workers rose 3.9% YoY in 2Q24, down from 7.8% in 1Q24 and 6.5% a year ago. Slower income growth led to slower growth in consumer spending. Per capita household consumption rose 5% YoY in the second quarter, down from 8.3% in the first quarter and 11.9% a year ago.

In the second quarter, the annualized rate of quarter-on-quarter GDP growth slowed to 2.8%. Full-year GDP growth may come close to Xi’s 5% target but without policy changes, continued deceleration may put next year’s target out of reach.

Mounting pressure for Xi to overcome his stubbornness

At two leadership meetings in July, Xi suggested that although he understands the need to restore confidence, he is too stubborn to deploy the rhetoric and policy changes necessary to accomplish that.

In reports from the Third Plenum, a gathering of over 300 senior Party officials, Xi said that “we will see that the market plays the decisive role in resource allocation,” and “we will support capable private enterprises in leading national initiative to make breakthroughs in major technologies,” and that he wants to “promote entrepreneurial spirit.”

That was, however, not accompanied by any meaningful policy changes designed to support private firms, and, in the same report, Xi said his government “will help state capital and state-owned enterprises get stronger, do better and grow bigger.”

A couple of weeks later, a statement following a Politburo meeting of the top 24 Party officials, described the economy as “stable,” while also acknowledging that domestic demand is “insufficient” and the external environment is difficult. The Politburo called for pro-growth macro policies that strengthen consumption, and said “we must promote entrepreneurship,” but this is unlikely to be enough to restore confidence and get growth back on track.

In my view, Xi will eventually feel under growing pressure to overcome his stubbornness—as he did with zero-COVID and property—and course correct to rhetoric and policies that rebuild trust among China’s small businesses and consumers. He will, at some point, acknowledge that these changes are necessary to achieve his economic objectives, which are central to his broader goals for his nation.

It is, unfortunately, impossible to predict when Xi will change course. We should be prepared to continue our frustratingly long wait.

In the meantime, the pace of economic growth will remain decent but not inspiring. Bar and restaurant sales, for example, rose 5% YoY in the second quarter, and in each of the last six quarters, since the end of zero-COVID restrictions, household consumption grew faster than income.

Potential after Xi returns to pragmatism

When Xi does course correct in a pragmatic way, it is likely that Chinese entrepreneurs and consumers will bounce back. They have, historically, been tremendously resilient.

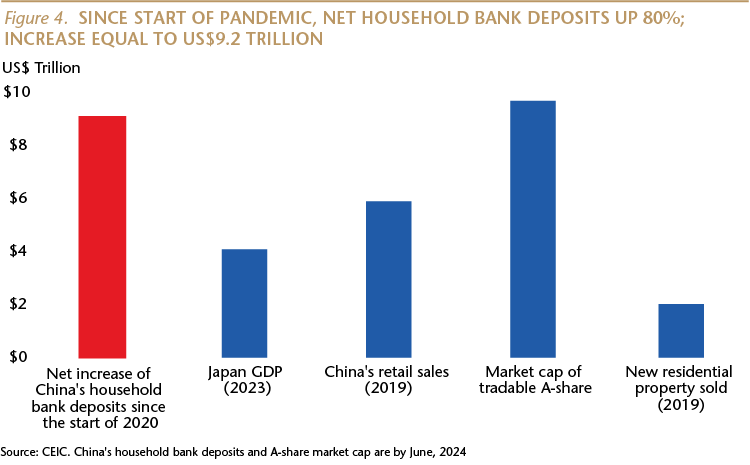

That resilience is likely to be supported by continued accommodative monetary policy and high savings. Family bank balances have increased 80% from the start of 2020, as Chinese households were in savings mode during zero-COVID. The net increase in household bank accounts is equal to US$9.2 trillion, which is greater than the GDP of Japan in 2023, and greater than the value of China’s pre-COVID 2019 retail sales. In my view, this could be significant fuel for a consumer spending rebound, as well as a recovery in mainland equities, where domestic investors hold about 95% of the market.

Andy Rothman,

Investment Strategist, China

Matthews Asia

Note: The G7 countries include the United States. Canada, France, Germany, Italy, Japan and the United Kingdom.