India Undimmed

Portfolio Manager Peeyush Mittal explains how growing exports and expanding manufacturing are helping sustain India’s economy amid rising prices.

SubscribeHow is India managing inflation?

It’s obviously a challenge. The increase in costs have started to impact demand, mainly on the consumption side. So it's no surprise that we are seeing some of the rating agencies and brokers downgrade their forecasts for GDP growth in India. However, while in the past, high oil prices have meant high inflation and slower GDP growth, we believe India is now in a far better situation in terms of rupee stability. The central bank is now sitting on close to $600 billion of reserves.

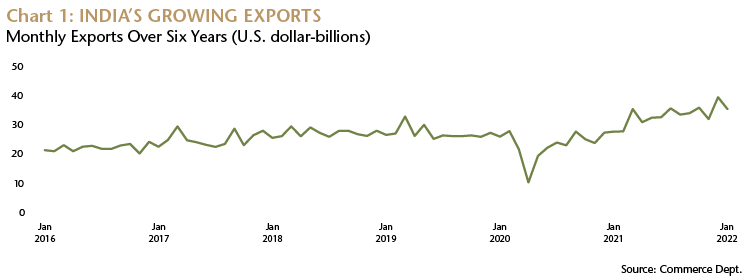

Another good sign is that we’ve seen a lot of speculative money exit the Indian equity markets over the last few months and despite that the rupee has been fairly resilient. And unlike the last time oil prices spiked, the inflation we are seeing today is a global phenomenon. Exports are also growing and this improves the situation in the sense that this time around, the current account deficit will likely be far more contained as compared to the past.

What’s your view on valuations?

Valuations in Indian equities have been historically high for the past year or so. Many industries in India continue to trade at significant premiums to their long-term averages despite some of the negative returns we’ve seen and the tightening monetary policy environment. Given recent downward GDP revisions, potential returns in India’s equity markets in the short term are likely to be challenged.

What about long-term growth?

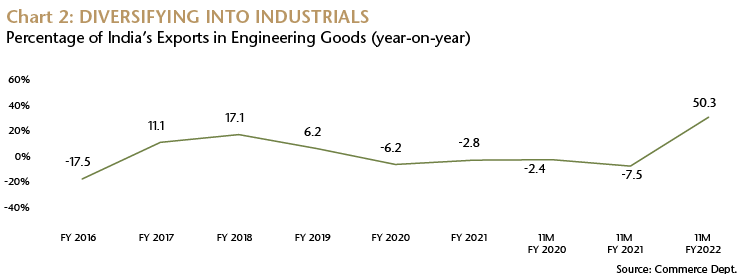

It’s promising. We've seen a tremendous improvement in the export market. India is known for exports of services and commodities but manufacturing has not been its forte. More recently, with concerted effort from the government, we are beginning to see exports grow and within this, engineering goods, like machinery, components, equipment and vehicles, are doing very well.

In terms of the economy generally, along with industrials, we think India’s information technology (IT) sector will continue to flourish as more multi-national corporations (MNCs) look to India to provide support services. There has also been a substantial recovery in the banking sector, which is now well capitalized to deal with any adverse credit issues. So we think financial services firms will prosper over the long term as they aid key sectors.

Can India be a portfolio alternative to China?

Well, there are no significant geopolitical risks or COVID lockdowns in India like there are with China and, as with China, India has the capability to deliver high rates of return. The infrastructure of India’s economy is also improving, trade with Europe and the U.S. is expanding and MNCs from developed markets like Germany are increasingly looking to India to shift their operational and manufacturing hubs there to lower costs to help combat inflation. So long term, we see a very positive story.