The Investment Portfolio Approach

Emerging markets offer the potential for long-term diversified investment returns but they can endure challenging periods of volatility and uncertainty. Head of Portfolio Strategy David Dali maps out the issues to consider when constructing and managing a portfolio for emerging markets.

We are strong believers in the long-term growth potential of emerging markets. While macroeconomics and company earnings are key factors to consider when investing in the asset class, equally important are country- and market-related considerations and how they meld with interest rates, currency and company fundamentals to impact the drivers of investment returns. For us, that means a portfolio approach that blends country selection and bottom-up strategies to manage growth and risk is crucial. It enables us to adopt defensive and offensive postures across different markets and through the short and the long term.

Short-Term Headwinds

For the most part, the long-term case for emerging markets is intact and we would argue that it’s getting stronger, thanks to improvements in the financial health of emerging markets and the emergence of structural trends such as artificial intelligence (AI ) and energy transition. But to position for the long term, the investor has to manage the short term, and the headwinds are invariably numerous and, often, unforeseen. The market today, characterized by volatility and uncertainty, amply illustrates this.

As we approach the end of the first quarter of 2025, we are beginning to see the impact of trade policies of the new Trump administration. What initially seemed like a light touch in terms of new tariffs has been overtaken by a rapid and broad rollout of import duties in markets and regions across the globe. Economic concerns over this rollout, and the retaliatory actions being triggered, are jolting many asset classes, from equities to bonds.

“Many areas of short-term volatility are country-related concerns. That is why it is important to measure the risk and impact of national and domestic factors on the drivers of investment returns.”

The imposition of U.S. duties on Mexico and Canada and increased tariffs on China at the beginning of March triggered a decline in 10-year bond yields and the U.S. dollar and a decline in the S&P 500 Index. The market’s reaction is illuminating investor concerns that tariffs and a tariff war may hurt economic growth in the U.S. and damage confidence at a time when businesses and consumers are still coping with inflation and growth among big tech companies is coming under scrutiny.

Butting up against an uncertain global trade environment are concerns over the macroeconomic climate. With inflation proving stickier than anticipated, it’s clear that the Federal Reserve is now on a much slower path of rate cuts. The prolonged existence of elevated borrowing costs are a hurdle for economic growth and a brake on innovation, and they also impact countries with a big dependence on global trade such as Brazil and Mexico. This environment, like tariffs and partly because of tariffs, is also fluid.

There is also uncertainty within emerging markets. China, the second-largest economy in the world, has still to demonstrate that it’s not in a prolonged deflationary slump. Consumer confidence remains weak as households worry over a depressed property market and a relatively subdued domestic economy.

What these areas of short-term volatility have in common is that they are all at the country or market level. Hence, it is important to measure the risk and impact of national and domestic factors as well as company and macro factors on investment returns.

While the near-term outlook for emerging markets may be hard to read, it’s important to build a portfolio that positions for both the weeks and months ahead and also charts a longer-term path. Our platform is to take what we believe are the four key drivers of emerging market returns: earnings growth, dividends, valuations, and currency, and apply them to the portfolio construction process.

“Stock prices can move for many reasons and often those reasons have little direct connection to the companies with the exception of where that company does business.”

A Portfolio Approach to Emerging Markets

As active managers, we are aware of the active risks we take at the country, sector and stock level as well as the risks associated with style factors like value, growth, market capitalization and volatility. We are also attuned to the overall beta risk we take compared with our benchmarks. Additionally, our approach ensures that we have a view on each of the four drivers of equity returns, especially the fundamentals associated with earnings growth and changes in valuations.

Inherent to our portfolio construction approach is the principle that countries matter. Stock prices can move for many reasons, often those reasons have little direct connection to companies with the exception of where that company does business. Historically, emerging market country index returns can vary between 30 and 100 percentage points per year. Therefore, we always begin our portfolio assessments with individual market considerations to rank our countries in terms of potential total return and risk.

We approach portfolio construction by first assessing a country’s potential return, based on our view of the aggregate earnings growth of its listed stocks, along with the potential re-rating of its index multiple, plus any distributed dividends and change in foreign exchange rates which affect U.S. dollar returns. Once we’ve established a view of potential individual country returns, we then consider allocation weights. The last step at this level is to beta-adjust the weights of countries to ensure we account for individual market volatility and risk. This process helps determine our geographical exposure and the countries where we are overweight, underweight or neutral relative to benchmark indexes.

While country allocation is a critical consideration, we expect most of our alpha—returns in excess of the market—to be generated from stock selection over time. Here we leverage our deep bench of portfolio managers, sector experts and analysts to generate individual stock ideas. Ideas are presented in a similar framework to our country consideration process, whereby individual companies are evaluated and target stock prices are established based upon the four drivers of equity return. Individual stock weights are informed by potential returns and then beta adjusted and sized for liquidity and other risk measures.

Portfolios don’t stand still—they are fluid and dynamic. Over time, positions are added and removed, and country and market weightings are reassessed and revised.

Why Countries Matter

Assessing country-level factors is critical for the emerging markets investor. Research shows that getting individual markets right can help portfolios generate strong excess returns above the benchmark, just as getting industries right can often help developed markets generate excess returns. And the difference in stock market returns between the best-performing countries and the worst-performing countries in emerging markets can be substantial. A company could have great prospects and fundamentals but its performance could be impeded or even neutralized by negative nation sentiment. So setting country weights appropriately is not only a key for managing growth it is also a key for managing risk. Here's a closer look at some key country-related traits as we see them developing in emerging markets today.

- Economies

- Countries move at different speeds, particularly in emerging markets, which can present different challenges. India, for example, is projected to expand at around 6.5% per year through 2029 due in large part to infrastructure.1 Recently, growth has faltered as businesses and consumers contend with inflation and high interest rates. At the same time, many Indian companies’ valuations are rich so investors have to be mindful of paying too much for a stock whose fundamentals have deteriorated.

In contrast, China has been struggling to demonstrate that its post pandemic malaise is not the beginning of a prolonged phase of muted growth and deflation. Many companies with a domestic focus have been affected by the nation’s weak growth, particularly in its struggling property sector, as well as by disruptive regulatory interventions. More recently, there have been promising green shoots of recovery in China’s markets, predominately in the AI and internet/e-commerce fields, but economic challenges remain an overhang for many businesses and consumers.

- Countries move at different speeds, particularly in emerging markets, which can present different challenges. India, for example, is projected to expand at around 6.5% per year through 2029 due in large part to infrastructure.1 Recently, growth has faltered as businesses and consumers contend with inflation and high interest rates. At the same time, many Indian companies’ valuations are rich so investors have to be mindful of paying too much for a stock whose fundamentals have deteriorated.

- Macro

- Interest rates are easing globally albeit more slowly than anticipated compared with just a few months ago. And as rates decline, there is an expected decline in the U.S. dollar, which is typically a boon for emerging markets as more FDI is attracted to them and their liquidity improves. Japan and Latin America are anticipated to be among the biggest beneficiaries of easing U.S. monetary policy. Latin America’s key markets of Brazil and Mexico have large exposure to the global economy and have experienced prolonged inflation. In Japan, as U.S. rates come down, its rates are rising and we believe the spread between the two rates will narrow, which is good for trade between the two economies and will be supportive of Japanese equities, in our view.

“Geopolitical developments have to be tracked closely, and weightings reduced in markets when tensions move higher, regardless of the strength or quality of companies.”

- Geopolitics

- In recent years, the biggest source of geopolitical volatility has been between the U.S. and China. Since the onset of the first Trump administration in 2016, the U.S. and China have ploughed trade paths and economic strategies that have grated against each other, particularly in the field of technology. Geopolitical issues can develop quickly and unexpectedly and trigger high volatility. This means that developments have to be tracked closely, and weightings reduced in markets where tensions inch higher. regardless of the strength of companies.

- Domestic politics

- 2024 was a lesson to investors about what happens if the political landscape is ignored or treated lightly. Mexico’s equity market fell following Claudia Sheinbaum’s landslide election victory on concerns over her domestic reform agenda. South Korea, meanwhile, saw its markets hurt after its president briefly imposed martial law and was then impeached, while India’s equities fell after Prime Minister Modi failed to win a majority and had to secure a coalition of allies to stay in power.

- Fiscal strength

- A county’s fiscal strength can also be a source of volatility. Since the pandemic, international bodies including the IMF and the Bank of International Settlements have ascribed macro stability in emerging markets to prudent fiscal and monetary policies. But challenges among individual countries still exist. Investor sentiment in Brazil, for example, has been impacted with anxiety over the Lula government’s financial stewardship and spending agenda, as well as an adverse economic environment characterized by high inflation and high interest rates. National finances in Argentina and Venezuela have dissuaded investors from seeking exposure for years but there are now signs of improvement, particularly in Argentina.

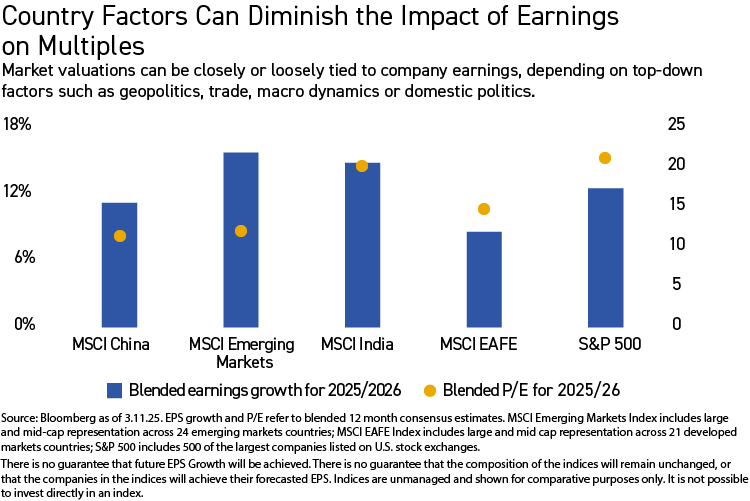

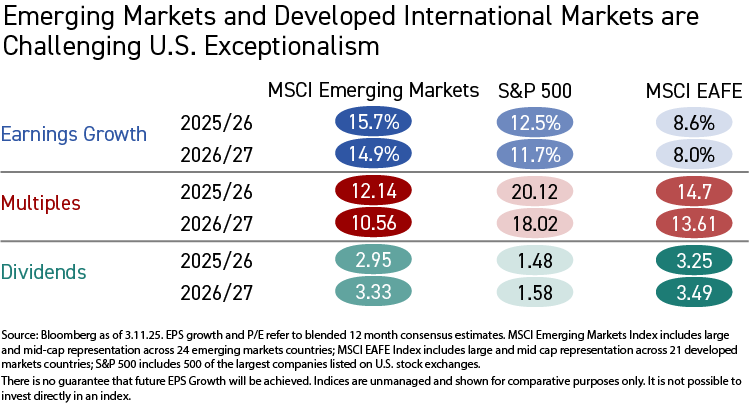

- Earnings and multiples

- Earnings growth at the national level can differ for various reasons including macro factors. For example, earnings growth in India has softened recently as high inflation and high interest rates have hurt consumer spending. More generally, emerging markets earnings have been recovering since the pandemic, as business and consumer spending returns. Emerging markets’ valuations remain close to long-term averages but are attractive in relative terms to both the U.S. and other developed markets.

Combining Country Selection with a Bottom-Up Approach: Why Quality Matters

While country considerations are critical, ultimately we invest in individual stocks. In addition to assessing a company’s earnings potential, we analyze a company’s ability to re-rate due to improvements or a deterioration in the quality of its business, product or management. Factors that impact the quality of a company include:

- Governance

- Transparency of ownership and management accountability are crucial areas that can enable or hinder investors to vet companies in emerging markets. Unlike in developed markets, information disclosure on business goals, product development, ownership and management accountability are often uneven and lacking in emerging markets. Governance standards can also be directly impacted by the regulatory environment, government intervention and the political landscape.

“Earnings growth outside the U.S. is quickly becoming competitive, and reasonable valuations favor additional re-rating momentum which makes diversification away from U.S. stocks an attractive alternative.”

- Capital efficiency

- In recent years, there has been progress in capital efficiency in certain markets which can manifest itself in increased dividends and stock buybacks. Many Japanese equities, for example, have benefited from government efforts to improve shareholder value. South Korea is also endeavoring to gain traction in this area, though it is a more challenging and complex goal because of the number of cross-shareholdings among family-controlled conglomerates.

- Quality of business

- Management team, competitive advantage, growth runway and operational excellence are among some of the characteristics that we also assess in the stock-picking process. Good earnings growth often stems from robust competitive moats, disciplined cost controls and sustainable long-term growth strategies. We look at the ability of the company to maintain an appropriate trajectory in revenue growth and profit growth.

Allocating to Emerging Markets

Market strategists are becoming increasingly convinced that the recent U.S. equity market dominance will soon be challenged by developed international and emerging markets. Earnings growth outside the U.S. is quickly becoming competitive, and reasonable valuations favor additional re-rating momentum which makes diversification away from U.S. stocks is a potentially attractive alternative for most global allocators. Declining global inflation, a weakening of the U.S. dollar and a lowering of Federal Reserve rates also could gradually add fuel for economic growth among emerging markets. Lastly, while the uncertain outlook and impact of U.S. tariffs on many countries may create volatility in markets, it could be a catalyst for changing supply chains and new areas of innovation that could support the growth of domestic economies in emerging markets, in our view.

For emerging markets, the attraction for investors has traditionally been associated with robust economic growth, strong demographics and urbanization, and the rapid development of consumer spending and a middle class. However, we also believe that, for the first time in a long while, potential long-term investment returns from emerging markets will be competitive with those of the U.S.

We believe a country selection-bottom-up approach is the best way to generate potential outperformance and manage risks in emerging markets. A country-to-company assessment of the drivers of investment returns can enable investors to take offensive stances and defensive stances according to the potential opportunities and challenges within their particular asset class. It also provides a pathway through the short term and into the long term as growth variables and risk variables take on different levels of scale and scope.

Key Investment Themes for Emerging Markets

Secular trends

Innovation and rapid deployment at scale, be it in energy transition, digitization or electric vehicle (EV) and EV battery development, is a key trait of emerging markets. Following the success of the Chinese low-cost open-AI platform DeepSeek—which challenged the validity of high CapEx outlays by large U.S. tech firms—AI has quickly become the new poster child for innovation in emerging markets. China is also at the forefront of robotics and autonomous driving in Asia while Taiwan and South Korea remain the world’s workshops for AI-related chipmaking.

India

India is encountering softening growth amid high inflation but we believe fiscal spending and other structural strengths, combined with India’s strong demographics and appeal as a business hub and partner to foreign capital, are long-term tailwinds that will benefit investors. Consumer spending has been a weakness in the Indian economy but as the government’s tax incentives take hold and interest rates likely take a downward trend, we think consumer demand in economy will become firmer.

China

We believe that China is in the process of righting itself and could provide optionality for investors as a long-term growth opportunity. We are seeing some recovery in China’s housing market and other sectors but we think this is a gradual development. For now, we are looking at fundamentals-driven buying opportunities and sectors with growth momentum that aren’t in the cross hairs of potential tariffs and investment curbs from the U.S. Critically, this means taking a measured exposure to China’s domestic economy as well as targeted exposure to higher growth areas like e-commerce, online platforms and technology.

Note: 1 IMF, as of October 2024