Key Takeaways:

- There aren’t many clear signals that China’s fortunes are about to change markedly for the better anytime soon. Yet avoiding China altogether may create an active investment risk in our view by limiting exposure to a potential long-term growth market, particularly if developed markets encounter increasing headwinds.

- One way to access China while potentially limiting exposure to its economic and external challenges is by investing in lower profile, innovative companies that are less in the crosshairs of the Chinese regulators or geopolitics.

- Investing in stocks a step removed from mainstream investment benchmarks isn’t the only approach to navigating China but we believe it’s one that has the potential to deliver near-term performance while enabling investors to bed in for a possible upturn in China’s economy and markets.

China hasn’t been working for investors. Its equity markets are in negative territory this year having posted double-digit declines over the past three years. And while U.S. has been the star performer in recent years, other emerging markets have also done better than China, significantly in the case of India and Mexico. And there aren’t many clear signals that China’s fortunes are poised to significantly turnaround in the near term.

It presents a dilemma for investors. Should China be avoided altogether or is there a way to overcome these challenges and access good performance while gaining exposure in additional geographies which could prove valuable if the other key global markets, particularly the U.S., slow or take a downturn.

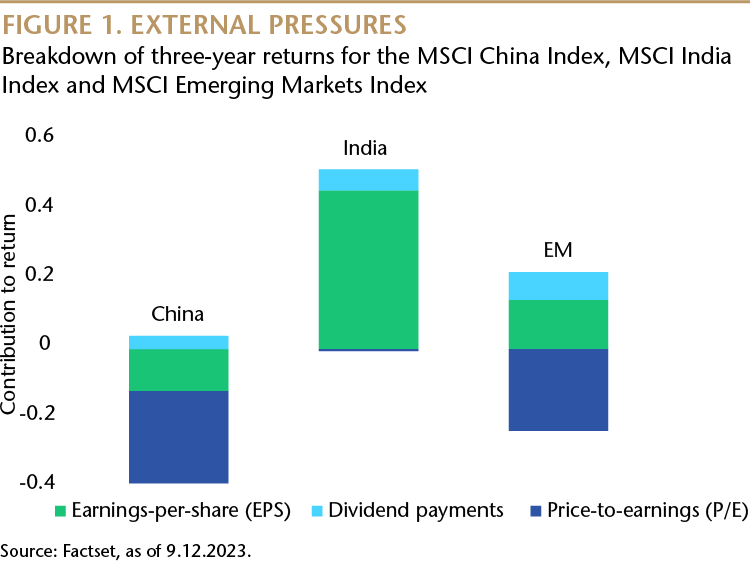

If we step back for a moment and look at the sheer scale of China’s economy, we believe there are an abundance of quality companies for investors to get exposure to. Let’s not forget that China remains at the heart of global economic growth and its equities represent around 30% of the MSCI Emerging Markets Index. Concerns over geopolitics, regulatory crackdowns and real estate sector challenges have weighed considerably on shareholder returns. As can be seen from the chart, most of the three-year loss of the MSCI China was attributed to multiple contraction–or the fall in valuations due to factors not related to stock fundamentals such as earnings or dividends. But if we strip these away these external and sector-specific factors, the fundamentals of many Chinese companies are robust and the potential returns are attractive, in our view.

So how then can we find quality companies that are limited in their exposure to China’s macro and external challenges? One way is by investing in lower profile, innovative companies that aren’t in the crosshairs of Chinese regulatory scrutiny or the negative sentiment stemming from geopolitical tensions between China and the West.

The first step, we believe, is to acknowledge that in China, government involvement in the economy is often never far away. Investors need to be aware as much as they can of the regulatory landscape and then steer a path that stays on the right side of government policy and avoids sectors that could overtly be on the receiving end of new interventions. Similarly, it is also important to stay clear of exposure to sectors and stocks where negative geopolitical sentiment is at its most intense, for example, in the segments of high-end semiconductors and technology hardware.

Quality companies

The next move is to take a closer look at the types of companies that fare well against these filters and are flourishing as businesses. Quite often we find that many such enterprises are in innovative segments serving China’s domestic economy, like affordable housing, health care, alternative energy, automation, leisure and entertainment and consumer goods and services. These segments are crucial to the long-term buildout of China’s internal economic infrastructure and to the country’s goal of reducing wealth disparity and improving quality of life for its citizens. They are also less exposed to global cyclical demand where margins can be pressured, and to the vagaries of international investors’ sentiment which, in good times, can mask shortfalls in fundamentals.

“A differentiated approach focused on well-run companies that aren’t in the headlights of geopolitics or sectoral challenges can help investors find successful ways to invest in China.”

From here it’s down to active stockpicking on a business-by-business basis. This means looking at company fundamentals like addressable market opportunity, competitive advantage, business models and management quality.

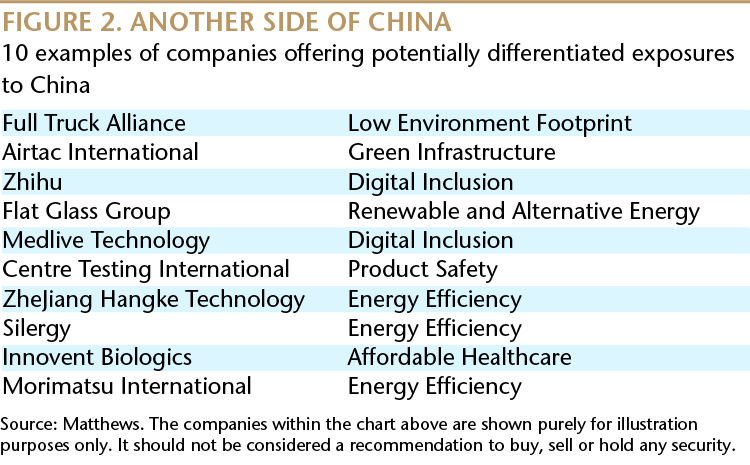

Taking a more sector-focused or thematic strategy, for example, in energy transitions or artificial intelligence (AI), is an alternative path for investors. But in our view, an overly top-down approach without conducting strong bottom-up due diligence can detract from key company assessment of ownership structures, regulatory frameworks and management teams and can expose investors to volatile return profiles. The chart below illustrates the opportunity investors have to build a differentiated exposure in China in industries that are innovative and diverse with good long-term prospects.

Of course, no Chinese company is immune to negative sentiment stemming from macro, regulatory or global tensions. China’s outlook will likely remain challenging at least for the short term. But with a differentiated approach focused on well-run companies that aren’t in the headlights of geopolitics or sectoral challenges, we believe investors can find successful ways to invest in China.

Active involvement

Achieving exposure to any market that looks beyond the benchmark and is cognizant of external challenges and sentiment, requires active investment management rather than a passive index approach. Active investing also has the ability to engage with companies and vet their business models and management pedigree. It’s also important to note that executing a differentiated approach to China doesn’t require taking a single-country approach—more general strategies with exposure to China can also effectively achieve this goal, in our view. More general strategies also provide the opportunity to take a differentiated company approach to other emerging markets like India.

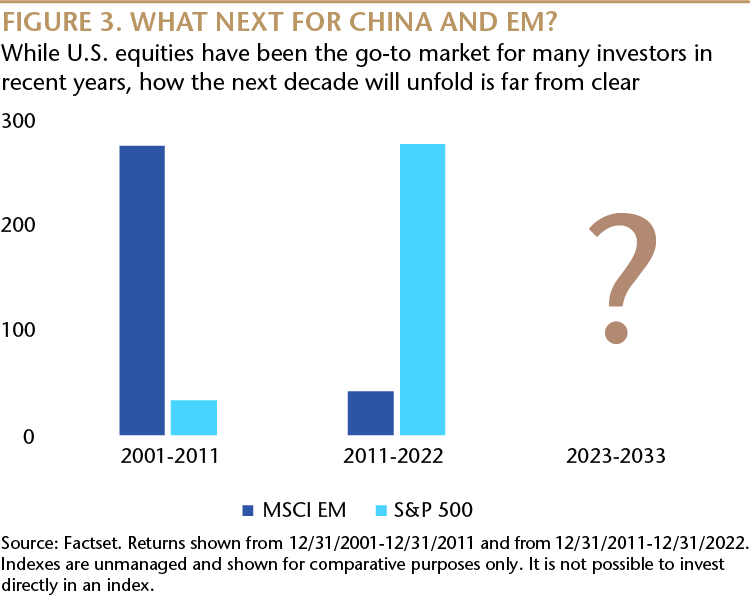

As we look to the next decade, getting exposure to China today may also prove to be a valuable diversification tactic. Financial conditions in the U.S. are tightening while the economic strings in China are being loosened. This doesn’t necessarily mean that China is about to embark on rapid economic recovery or that it will help create a repeat of the first decade of the century when emerging markets outperformed the S&P 500. But the current global economic landscape and the huge relative performance differential over the last decade between the U.S. and emerging markets gives enough reason for us to believe that investors should consider building diversified exposures in equity assets that operate in key overseas growth markets like China.

David Dali

Head of Portfolio Strategy

Matthews Asia

Vivek Tanneeru

Portfolio Manager

Matthews Asia

Definitions:

Earnings-per-share (EPS): the amount of annual profit (after tax and all other expenses) attributable to each share in a company, calculated by dividing profit by the average number of shares on issue.

Price-to-earnings (P/E) ratio: The valuation ratio of a company's current share price compared to its per-share earnings.