Innovation Ignites Alpha in Asia

Small companies provide an opportunity to invest in Asia’s innovation edge and entrepreneurial spirit at an early stage.

Overview

- Educated workers, evolving capital markets and a vast consumer market have helped create a robust innovation ecosystem that nurtures both small and large companies across markets and sectors in Asia.

- Finding innovative companies early in their lifecycle can add alpha to portfolios – a bottom-up and active process is key to idea generation and risk management.

- Our showcase of innovative smaller companies highlights the depth and diversity of opportunity.

At its best, innovation can drive rapid revenue growth, superior competitive positioning and create an economic moat for businesses. Within the innovation cycle, there is a key component. Smaller companies are often both the source of innovation and the bridge that enables emerging and fast-growing countries to transition to higher-value added economies and compete at a bigger scale.

Many smaller companies, which we generally define as US$1-5 billion in market capitalization, operate in nascent and fast-growing industries. In some countries, they may lack access to capital which can make them more competitive, innovative and capital-efficient than their larger peers.

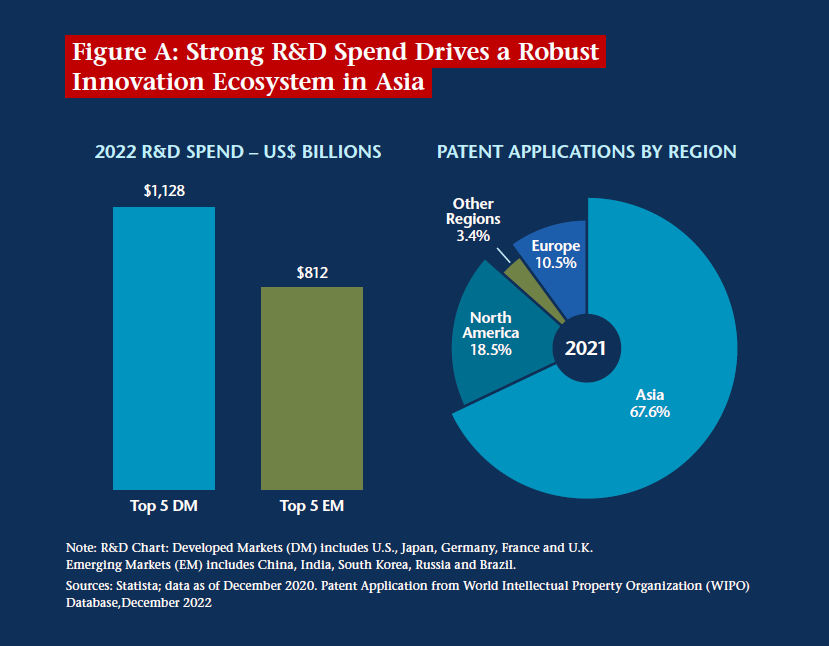

In Asia, the innovative potential of smaller companies has changed dramatically in the last decade thanks mainly to three developments: the growth of a large, highly educated, well-trained workforce, with more engineers, PhDs, and filed patents than any other region; the entrenchment of a sizable venture capital and public equity markets; and the emergence of Asia as the world's largest addressable consumer market. These three factors have supported a strong R&D spend that has helped create a robust innovation ecosystem in Asia which nurtures both small and large companies across markets and sectors.

As this ecosystem has evolved, so too have investment opportunities. For example, secular opportunities in sophisticated industries, from automation and digitalization to entertainment and healthcare, are set to supersede growth from high-volume basic industries. In our view, investors can capture these secular growth trends most effectively by gaining exposure to innovative small-cap companies that will come to dominate these new industries.

Teeming with growth

Small companies have always been an integral part of the Asia’s economy and as capital markets have deepened, the investment universe has grown considerably. A significant proportion of this growth has come from China. Between 2007 and 2022 the number of Chinese small caps surged, most notably in the innovative sectors of information technology, from 180 to 932, and healthcare, from 127 to 574 (see Figure B). In these two sectors, the universe has nearly twice the number of growth stocks than the MSCI China Index.

In many ways China is a natural home for small cap opportunities. Among urban employment, 88% work in small, privately-owned, entrepreneurial companies and China’s small-cap universe has grown to become one of the largest globally, with over 5,000 companies.1

Small companies have always been an integral part of Asia’s economy and as capital markets have deepened, the investment universe has grown considerably.

Small-cap specialisms

While innovative small caps can be found across all sectors and industries in Asia, they tend to reflect the different stages of development of the various economies. For example, in South Korea, Hong Kong and Singapore, we see innovation driven by aging populations, in areas such as biopharma and factory automation. In countries like India, Indonesia and Bangladesh, we find innovation among small companies providing both basic banking and private banking services.

In China, smaller companies benefit from the tailwinds of seemingly unstoppable trends, such as Chinese consumer upgrades and hyperconnectivity (see Figure C). These trends are associated with income growth, technology, manufacturing, and energy self-sufficiency, as well as market share opportunities and gains in complex supply chains previously dominated by foreign players.

Managing risk and reward

Over the past decades, we have witnessed many innovative companies rewarded for the product and service ideas that are meeting the new demands of a region of rising wealth in Asia.

Innovation, however, can also bring challenges as it sometimes captures investor interest on the basis of little more than speculation and excitement. We take the associated risks seriously and view our in-depth due diligence process as a key component of our ability to mitigate risk. We stick to a consistent philosophy and strategy, keeping in close communication with companies and remaining resolute amid short-term volatility.

In our experience, finding innovative companies early in their lifecycle can be a critical source of alpha; we often establish contact long before an IPO and the company potentially entering an exponential growth phase as getting to know company management has been a key part of our investment process.

We believe a bottom-up process is particularly suited to Asian small caps. This involves visiting companies on-the-ground – headquarters, factories, stores, and talking to management, suppliers and customers – as well as investigating financials.

In an economic downturn or when financial conditions tighten, small companies generally find it harder to access capital compared to large companies. Seeking small companies with strong balance sheets, superior cash generation capabilities and low leverage ratios can effectively address these potential funding challenges and underlines the importance of fundamental research.

Over the past decades, we have witnessed many innovative companies rewarded for the product and service ideas that are meeting the new demands of a region of rising wealth in Asia.

Forward looking exposure

We believe small companies provide an opportunity to invest in Asia’s innovation edge and partner with minority shareholder-friendly entrepreneurs at early stages. Yet the region’s benchmarks do not adequately reflect its potential. As active investors focused on Emerging Markets and Asia, we believe they are too backward-looking. Many of the exciting trends we see today will be reflected in the major regional benchmarks only in years or decades to come.

|

Legend Biotech Silergy Bandhan Bank EcoPro BM Zhejiang Shuanghuan Driveline Morimatsu International |

1 CEIC, as of October 27, 2021

Definitions

Alpha Alpha, a commonly quoted indicator of investment performance, is defined as the excess return on an investment relative to the return on a benchmark index.

Leverage ratio A leverage ratio is any one of several financial measurements that look at how much capital comes in the form of debt (loans) or assesses the ability of a company to meet its financial obligations.

MSCI China Index The MSCI China Index is a free float–adjusted market capitalization–weighted index of Chinese equities that includes China-affiliated corporations and H shares listed on the Hong Kong Exchange, and B shares listed on the Shanghai and Shenzhen exchanges.