Fueling Sustainability in Emerging Markets

Smaller companies fuel Emerging Markets’ sustainability journey.

Overview:

- Sustainable smaller companies are often overlooked in emerging markets and Asia, yet in our experience they play a key role in rapidly expanding global supply chains.

- Smaller companies with sustainable business goals are often easier to understand than conglomerates with multiple sustainable goals and interests, but the consistency and availability of standardized key sustainability data can be spotty.

- Proprietary research and company engagement are key tools for identifying small cap-sustainable leaders and unlocking their value.

Sustainable industry is in many ways the calling of small companies. As countries are pressed into making their industries more sustainable, inclusive and equitable, doors can open for startups, whether they are helmed by visionaries, have new solutions to the bring to the table or have innovative ways of working.

Smaller companies often don’t have high profiles in the sustainable portfolios of investors but many in emerging markets and Asia are already playing key roles in rapidly expanding global supply chains, such as in vital chemicals and components __to global electric vehicle (EV) battery makers. At a more general level, smaller companies are making inroads in areas ranging from energy transition, industrial digitalization, and agricultural technology to recycling and waste management.

The size of capital markets in some emerging markets, like Pakistan, Bangladesh and Vietnam, can also mean that local market leaders often fall within the small-cap category and yet remain under the radar of the broader investor community.

Pure play advantage

Small companies can offer several advantages over bigger peers in the sustainable investing space. The first is that they are far more likely to be pure-play companies, focusing on delivering goods or services aligned to a single positive outcome such as financial inclusion or carbon efficiency. It is therefore easier to understand their business model and their sustainable goals.

Responsible investors can also potentially have more leverage over small companies. Small and mid-cap companies often are not advanced in terms of their external institutional investment communications and strategy and that is where we can engage with them and create positive change. CEOs and CFOs are generally interested in stewardship conversations and can be quick to extract information and adopt best practice.

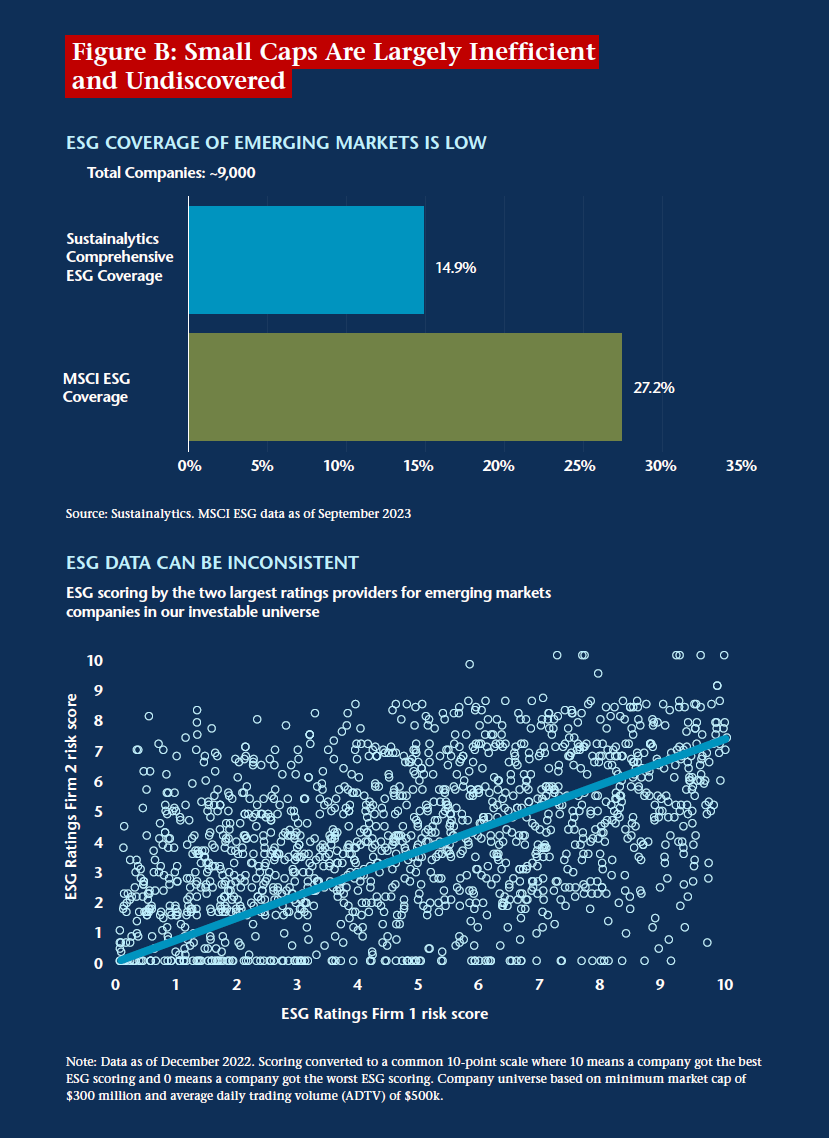

In our experience, the most exciting sustainable smaller companies are often hiding under the radar and require nuanced and complex analysis. Consistency, and even availability, of key sustainability data can be patchy (see Figure B), but proprietary research can help to navigate potential gaps. It is also important to contextualize any assessment depending on the local market and its form of corporate governance.

CEOs and CFOs are generally interested in stewardship conversations and can be quick to extract information and adopt best practice.

Active opportunity

The good news is that not only are smaller companies humming and growing in the sustainable industries of Emerging Markets, in our experience, but the lack of information generally available in this field of investing presents a huge opportunity for active asset managers prepared to do the work. Market inefficiencies can provide managers with the ability to capture alpha from undiscovered gems. Only through research and due diligence can investors verify an enterprise’s viability, assess its future chances of growth, and establish its sustainability credentials.

Our investment methodology is a bottom-up, fundamental process. We analyze available environmental, social and governance (ESG) research, including analysis not necessarily tagged ESG but nonetheless providing signals. We then fill the inevitably substantial gaps with extensive on-the ground research. We look for red flags, conduct visit sites and engage in enhanced disclosure discussions, often over multiple years and long before an IPO.

In addition, as small companies are typically embedded in value chains with large clients, we can cross-check their business models and sustainability practices to ensure they have the competitive advantage needed for success. This process regularly uncovers unexpected and interesting stories.

Engagement is the key

Unlike large, international public companies, small, listed businesses may not fully understand the expectations and needs of global sustainable investors. This is where active managers can unlock value by engaging with companies and, where appropriate, encouraging them to adopt more sustainable practice, or, in many cases, encourage them to promote or leverage a positive attribute, such as opposition to modern slavery. In our experience, small companies are willing to engage on ESG issues, especially when it is in their interest. Low ESG ratings by large international ratings agencies, for example, may negatively impact on overseas investors’ confidence and smaller companies generally have less access to capital compared to larger peers.

As an active investor, we engage with market participants, from regulators to stock exchanges, to raise standards and facilitate international investment. In South Korea, for example, we are very active with industry groups focusing on corporate governance; elsewhere, we are concerned about gender equality and other issues.

We can also often find ourselves working in the same direction as government policy. Hong Kong and Thailand already require listed companies to meet high standards and India recently widened its requirement for sustainability reporting from the top 500 listed companies to the top 1,000.

All this active engagement pays off because the growth potential of small companies can be very closely tied to sustainable factors. Many small firms are growing rapidly by creating pure-play solutions to environmental and societal problems and are poised to benefit from regulatory tailwinds. Importantly, they are also nimble enough to change tack and grow into new areas tomorrow.

Active engagement pays off because the growth potential of small companies can be very closely tied to ESG factors.

The information challenge

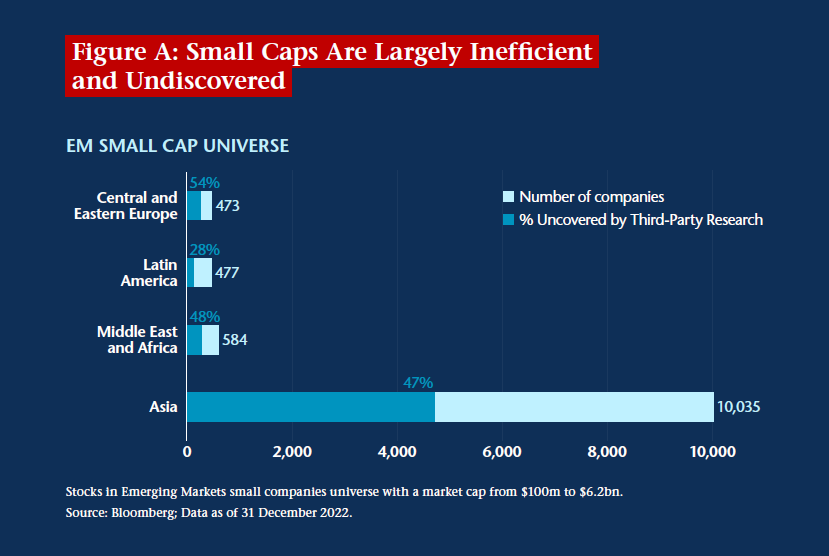

The greatest challenge to finding sustainable investing opportunities among Asia small companies is a lack of information. Some of the fastest growing and most vibrant markets have the lowest levels of fundamental stock coverage – just 50% in the Philippines – and this drops precipitously when it comes to analysis of the sustainable or environmental, social and governance (ESG) characteristics of companies.

In addition, Asia’s implementation of sustainability standards lags far behind the EU and U.S. Small companies in Asia are typically not required to disclose ESG metrics and third-party ESG agencies only cover around one-third of the emerging market investable universe. The lack of enforcement means companies can selectively report favourable metrics. A firm with naturally low carbon intensity may report CO2 emissions but not inconvenient social metrics, such as low female representation on its board. Even when ESG ratings and scores are available, they can be unreliable as agencies often default to low scores.

The backdrop makes it very challenging to implement in Asia the type of rules-based screening processes commonly employed in developed markets. It means active portfolio investing to identify long-term sustainable prospects is critical.

It is essential to take the time for in-depth company analysis – involving interviewing several layers of management as well as talking to clients, suppliers and competitors – while working on a timeframe that can take advantage of short-term volatility.

Small cap sustainability investment themesRenewable energy, transportation, industry, e-commerce and finance – over the long term, these opportunities offer tremendous potential value for sustainability investors and can be found across a range of sectors including consumer, health care, energy, industrials and financials. |

1. Bloomberg; Data as of 31 December 2022

Investments involve risk. Investing in international, emerging and frontier markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Additionally, investing in emerging and frontier securities involves greater risks than investing in securities of developed markets, as issuers in these countries generally disclose less financial and other information publicly or restrict access to certain information from review by non-domestic authorities. Emerging and frontier markets tend to have less stringent and less uniform accounting, auditing and financial reporting standards, limited regulatory or governmental oversight, and limited investor protection or rights to take action against issuers, resulting in potential material risks to investors. Investing in small- and mid-size companies is more risky than investing in larger companies as they may be more volatile and less liquid than large companies. Pandemics and other public health emergencies can result in market volatility and disruption.

Definitions

Alpha: Alpha, a commonly quoted indicator of investment performance, is defined as the excess return on an investment relative to the return on a benchmark index.

expectations reflected in these statements are reasonable, we can give no assurance or guarantee that these expectations will prove to be correct.