Our Thinking on China

Portfolio Managers Andrew Mattock, CFA, and Winnie Chwang share their insights on the tech rally in Chinese equities and what it may mean for broader investment returns from China in the future.

Investors have seen a lot of volatility this year but there is one market that has so far charted a path of relative stability and growth, far outpacing peers as well as the U.S. and other developed markets. Despite headwinds from the rollout of U.S. tariffs across the globe as well as China’s halting economic recovery, Hong Kong’s stock market has delivered a 12-month return of around 57% and a year-to-date return of around 23%.1

The latter performance has been laid firmly at the door of the artificial intelligence (AI) frenzy that followed the huge success of DeepSeek—the low-cost Chinese AI platform launched in January—which upended assumptions about CapEx spending on large language models. As big U.S. tech stocks including NVIDIA were rocked by the implications of DeepSeek’s model, Chinese tech stocks surged. Alibaba Group and Tencent Holdings have been among the chief beneficiaries, being quick to embrace the moment and offer their own AI products2. The rally was also buttressed when Xi Jingping met with China’s tech leaders including Alibaba’s Jack Ma in February and emphasized the priority the Chinese government would place on helping technology companies overcome regulatory and other barriers.

China’s False Dawns

But what does this tech rally mean for investing in China and how do we position portfolios for this evolving landscape without being too aggressive or too cautious?

Some context may be helpful. There have been numerous false dawns in recent years signaling that China’s economy and markets may finally be turning a corner. Each dawn was duly doused with negative sentiment over either weak earnings momentum, disappointing government policies, real estate woes or geopolitical tensions with the U.S. The most recent rally in late September and October, for example, was triggered after the Chinese government unveiled a broad package of stimulus measures which loosened monetary policy and introduced reforms to help local governments take excess property inventory off the market. But the rally proved short-lived after the government failed to sate market’s expectations that some follow-up fiscal spending measures would be announced.

And now we have had the gains in China tech stocks. So what, if anything, is different this time? We would suggest four areas that positively mark out this rally:

- Chinese engineering ingenuity

- The launch and impact of DeepSeek has been described as a Sputnik moment for the U.S. and for the rapidly evolving global AI industry. Perhaps most significantly, it demonstrated the scope of Chinese engineering in the face of U.S. curbs on the hardware and chip technology that Chinese firms can import. We would argue that this constrained environment has forced China’s chip technicians to think outside the box and innovate.

- An organic rally

- The second significant aspect of the tech rally is that it was driven by private sector innovations within the economy rather than by a stimulus from the government. Such internally derived economic growth opportunities are more sustainable than one-time external efforts.

- Permeation

- With DeepSeek, there has been a narrowing of the discount of China tech stocks. We believe that this can be sustained by the potential for open-source AI technology to be efficiently applied throughout a wide number of industries and sectors, enhancing productivity in a cost-effective manner.

- More than just AI

- There are multiple drivers behind the current rally. It is also tied to the strides China is making in other segments, like autonomous driving where China is expected to have significant global market share making it more on par with the U.S., and likewise in industrial and humanoid robotics in the upcoming decades.

- China is also making advances in the biologics sector to meet growing global demand to treat major diseases such as cancer.

- Meanwhile, other sectors are achieving historical milestones. The huge popularity of the animation movie “Ne Zha 2”—the first Chinese film to exceed US$2 billion in box office sales—has significant implications for the expansion and development of China’s film and entertainment industry.

The Broader China Market

Of course, the current China rally is still a relatively narrow and nascent one. It is a different story for sectors of the market that are more tied to China’s domestic economic challenges. The performance of China’s mainland equities, which are reflective of the domestic economy and China’s exports markets, have gained only around 1.9% this year and 16% over the past 12 months.1

Roughly, one third of mainland equities are tied to real estate-related industries, a third is dialed into consumer spending, predominantly staples, and the remaining third is tied to exports. Property and consumer-related stocks remain weak, reflecting China’s prolonged real estate slump and poor consumer confidence, while exports have taken a greater share of GDP recently to offset the slump in the domestic economy. However, many exports are high volume, narrow margin products and are now having to contend with the introduction of U.S. tariffs.

And if we look at Hong Kong-listed stocks, while the market has done well over the past 12 months, it has also suffered in recent years as overseas investors have been discouraged by heightened geopolitics with U.S. and high-value, high-growth sectors being disrupted and overhauled by new government regulations.

The Economy and Catalysts for Growth

To assess the prospects for China’s broader market and its drivers of growth, we need to look at the economy. It is unlikely that it will go back to the high-growth days of the 2000s and 2010s. The government's engagement is seen as a positive sign but we think China's recovery may take some time. We believe this is reflected in current annual growth projections of 4.6% by the IMF and 4.5% by the World Bank, as compared with the government’s own projection for a 5% expansion in 2025. There is the potential for higher growth, in the 6% - 7% range, but only if consumer confidence returns and the substantial savings pool begins to be deployed. This growth would still likely be different from historical patterns, driven more by consumption and services rather than property and infrastructure investment.

“A gradually stabilizing housing market could be the new normal that consumers settle into, and this stabilization could provide the confidence needed for improvements in the economy.”

To establish a floor under the market and for equity returns to be more sustainable, there needs to be stability in the Chinese real estate sector, in our view. Chinese property prices had month-on-month declines since September 2021 following the government’s strident regulations to diffuse what it perceived to be a bubble in the sector. After piecemeal concessions, incentives and, finally, material reform announced in September last year, we are starting to see some of the excess inventory clearing.

For us, this rebalancing in supply is key. We don’t necessarily think a rebound in China’s housing market is critical for the economy or for a catalyst to invest in China. A gradually stabilizing housing market could be the new normal that consumers settle into. This stabilization could provide the confidence needed for improvements in the economy and, in particular, for consumer spending to gain ground and for demand to start being added into the economy. Real estate is still a penetration story and consumer spending is also a penetration story so there is a lot of under-capacity in the economy.

A New Normal

There are also encouraging signs at the local government level. Anecdotal evidence suggests that local governments are becoming more active in paying their debts and invoices. This increased activity is because of new funding streams provided by the central government to local authorities. While this may not immediately appear in official data due to reporting lags, it indicates that economic wheels are starting to turn at the grassroots level.

In the run up to the National People’s Congress (NPC) this March, some investors had expectations that additional fiscal stimulus would be announced. But we believe the government is not inclined toward aggressive quantitative-easing measures or large fiscal spending initiatives similar to those seen in other major economies. This approach was illustrated at the NPC where most key metrics announced were in-line with expectations:

- 2025 GDP growth target: around 5% (2024: around 5%)

- Inflation target: 2% (2024: 3%)

- Budget deficit: 4% of GDP (2024: 3% of GDP)

- Special national + local government bond quota: RMB6.2 trillion (2024: RMB4.9 trillion)

- Consumer subsidies: RMB300 billion (2024: RMB150 billion)

- Bank capital injection: RMB500 billion3

There could be additional reforms or fiscal initiatives in response to on-going trade developments but we think the priority for the government is to achieve the GDP growth target, support the private sector and technology and focus on consumption support for the economy. In our view, the government’s strategy is to steer the economy toward a more gradual recovery that could potentially lead to more sustainable long-term growth and avoid the pitfalls associated with excessive monetary easing.

The potential biggest external headwind to a sustained rally or a long-term upside in Chinese equities is U.S. tariffs. While Trump 1.0 tariffs were focused on goods being imported from a narrow range of countries, predominantly China, Trump 2.0 encompasses nearly all regions and economies, including Canada and Europe. This sweeping approach has taken some of the attention off China, which is currently being taxed on its exports to the U.S. at a rate of 25%. The Trump administration has signaled an openness to negotiate with China but the trading landscape could change very quickly. Currently, China is overly dependent on export revenue due to its faltering domestic economy and we are mindful that a ratcheting up of import duties would undoubtedly hurt.

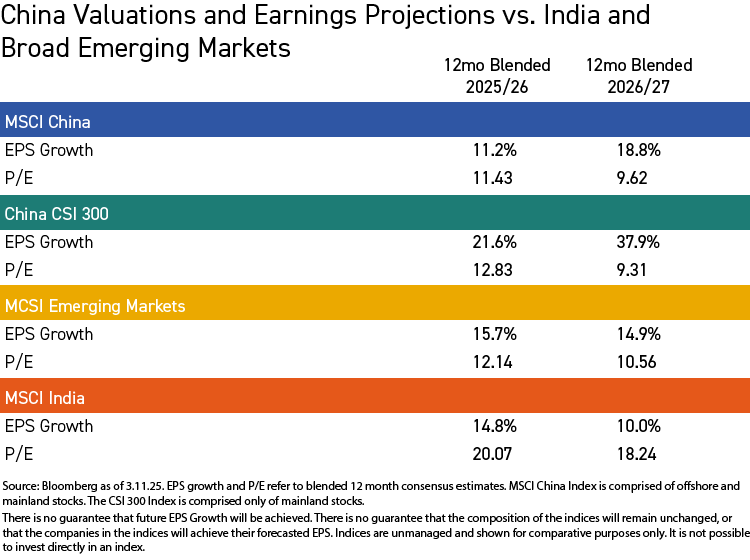

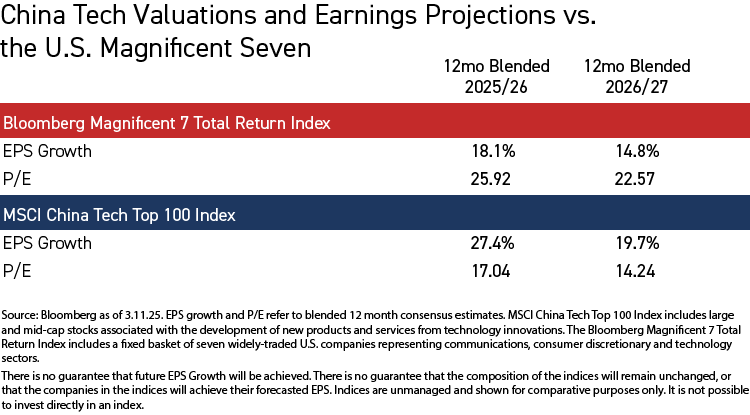

Valuations and Earnings Growth

Overall, if we look at valuations and earnings growth among Chinese-listed companies, we can conclude that there are some high-quality companies, with promising earnings runways and considerable total addressable markets, particularly in the Hong Kong market. The valuations of these stocks are also often cheap compared with peers in other markets, even after adjusting for external headwinds like tariffs and geopolitics.

In terms of earnings growth, we anticipate more earnings upgrades in the Hong Kong and offshore markets as the outlook for e-commerce and tech stocks improves. In the mainland market, we don’t think earnings have bottomed out as the housing market and consumer spending are only now showing signs of starting to turn around.

Investment Approach and Positioning

In some ways, we believe investors need a reset or a rethink on the strengths and characteristics of the Chinese stock market and on the sources for the potential returns it can offer. We advocate a broad approach to the market, mindful of earnings and valuations but, at the same time, attuned to specific opportunities.

Investors should remain attentive to short-term factors while recognizing the particular aspects of China's economic model and market structure. For example, we believe companies in the offshore market are further ahead in terms of cost controls, margin expansion, capital efficiency and innovation areas such as AI, robotics and health care. We also believe it is important to be strategically positioned for a pickup in the mainland market which may only need a modest improvement in economic indicators for earnings to improve and for stocks to start to deliver broad returns for investors. Patience is also required as the impact of government stimulus gradually materializes. Intertwined with this is trade with the U.S., and any further changes to the tariffs being imposed on Chinese imports.

Broader Opportunities and Challenges

Financials

Financial stocks, including banks, life insurance companies and brokerage firms, stand to benefit from the initial stages of a broader market recovery in China, in our view. They offer potential “double leverage” benefits. These companies are currently trading at reasonable valuations while holding significant equity investment portfolios. As market conditions improve, they stand to benefit both from their core operations and their investment holdings.

Consumer

Consumer-oriented sectors, particularly those tied to digital services, gaming and e-commerce, remain robust. These businesses have demonstrated resilience through margin improvements and continued revenue growth, even amid economic slowdowns. This has been driven by two key factors:

- Structural Growth: Many consumer categories in China still have significant penetration potential unlike more mature markets like the U.S. Services, including food delivery, ride-hailing and e-commerce, continue to show strong growth as they expand into lower-tier cities and new customer segments.

- Margin Improvement: Platform companies have successfully enhanced their profitability through improved monetization strategies even in a challenging economic environment.

In addition, the substantial savings pool in China represents potential spending power that could be unleashed as consumer confidence recovers.

Tourism and Services

The tourism sector has already shown signs of recovery and appears positioned for further growth. Service companies, more broadly, should benefit from increasing domestic consumption.

Exports and Manufacturing

China’s export sector has traditionally been a pillar of economic growth but geopolitical tensions and tariffs could impact its momentum. While Chinese electric vehicles (EVs) and select industrial goods continue to gain global market share, we need to be mindful of softening demand and trade barriers which warrant a more selective approach to investing in export-related industries.

Construction and Infrastructure

Unlike past cycles, the Chinese government is not likely to drive growth through massive infrastructure investments or aggressive land auctions for property development. This means that while real estate prices may recover, construction-related industries such as cement, steel and heavy machinery, may not experience the same level of resurgence.

Key Takeaways

- There is evidence emerging of a bottom being reached in China’s housing downturn and that overall business conditions have begun to improve. At the same time, technological breakthroughs are adding to confidence in China’s innovation abilities.

- As China recovers, we don’t see a return to the growth of the past. China is in economic transition. The economy is becoming more consumer-oriented, financially sophisticated and services-focused. While this transition may create market volatility, it will be one that offers both broad and targeted opportunities for active investors

- Key success factors for investors will include:

- Understanding the shifting nature of Chinese economic growth

- Identifying companies with sustainable competitive advantages in growing sectors

- Maintaining a long-term perspective while being prepared for near-term volatility

Note: 1Bloomberg, as of 3.18.25; 2As of February 28, 2025, portfolios managed by Matthews did not hold positions in NVIDIA. As of February 28, 2025, accounts managed by Matthews portfolios held positions in Alibaba Group and Tencent Holdings; 3U.S. Embassy of the PRC