What’s Driving South Korea?

Portfolio Manager Sojung Park assesses the outperformance of South Korea’s equity market in 2025 and explores the themes that could support sustainable investment returns.

SubscribeKey Takeaways

- South Korea is competitive in key global industries and well-positioned in fast-evolving sectors.

- Corporate governance reforms are creating value, supported by strong policy initiatives.

- Memory makers hold dominant market positions within the long-term Artificial Intelligence (AI) secular theme.

- Korean equities remain attractively priced despite the market’s strong outperformance.

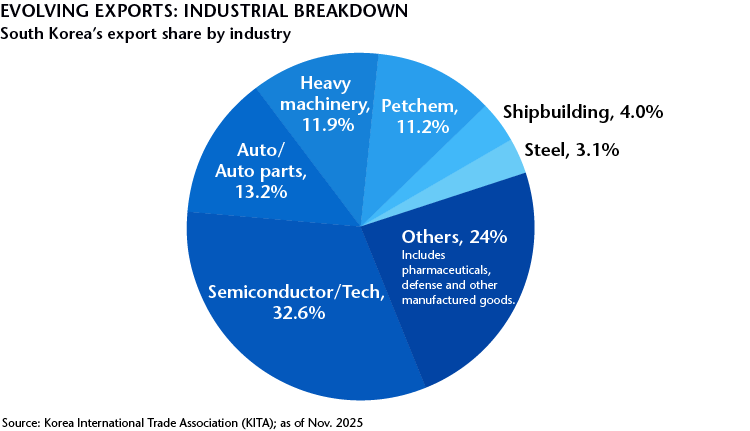

South Korea was the top performer in emerging markets equities in 2025, generating a 70.9%1 return in U.S. dollar terms through December 15 last year. It has outperformed peers as well as developed markets, including the U.S. While the Korean market has been a significant beneficiary of the global AI boom, its strong performance is supported by broader factors. We believe the economy is well positioned to capture growing opportunities in industries such as shipbuilding, defense, and power equipment. It is a dynamic economy with a strong focus on innovation which is aligned with rapidly evolving industries. Korea also continues to maintain competitiveness in key global sectors such as autos and biopharmaceuticals. In this paper, we outline how the convergence of key tailwinds is driving Korean equities’ performance and why these factors could support sustainable long-term returns.

Economic drivers

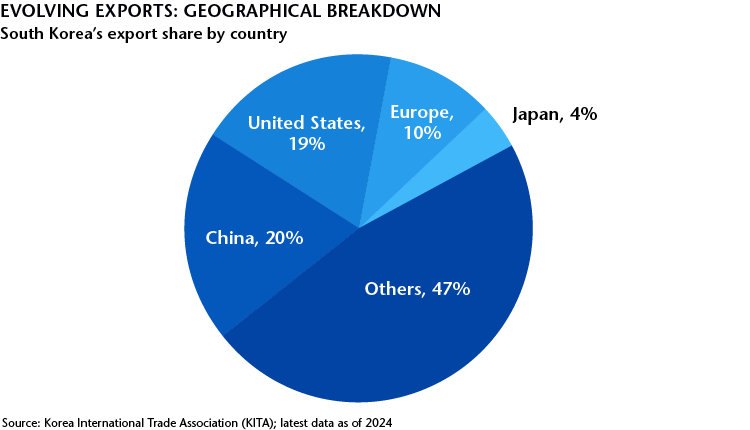

South Korea’s economy is structurally orientated to exports. After gaining prominence in the 1950s and 1960s through textiles and basic chemicals, it expanded into heavy industrials, including steel, petrochemicals and shipbuilding during the 1970s, and into autos and electronics in the 1980s and 1990s. This century, Korea has continued to build multiple economic pillars, supported by advancements in technology, biotechnology and renewable energy. The most recent and high-profile driver has been the digital technology and AI boom, with Korean technology companies now global leaders in the Dynamic Random-Access Memory (DRAM) market, a critical component of AI. To appreciate Korea’s strength in the high-profile area of AI, it’s useful to first consider the broader industrial strengths that characterize its diverse economy today and position the country for the evolving needs of the global market.

Defense

One consequence of the Russia-Ukraine conflict has been the move by European nations to strengthen and modernize their military forces. Elsewhere in the world, countries are reviewing and upgrading their military profiles. Korea’s southern coastal city of Changwon is the primary defense manufacturing complex of the country. It is a dense, integrated industrial base developed over decades, with key manufacturers and component makers in close proximity. We believe this scalable land hub has the potential to offer greater efficiencies than many developed market defense supply chains which have become fragmented and downsized. In our view, rising global defense spending will become an increasingly important growth component for the Korean economy.

Shipbuilding

While China is the world’s dominant shipbuilder, particularly in the container ship market, Korean builders have a competitive position in highly specialized carriers such as liquefied natural gas (LNG) vessels and eco-friendly engine ships. Among the 760 LNG carriers in operation globally, about 70% were built in Korea. Additionally, there are signs that the U.S. may increase its reliance on Korean-built or Korean-backed vessels. As the Trump administration seeks to revitalize and rebuild its domestic shipbuilding industry as well as upgrade its military vessels, we think there is significant potential for Korean companies to invest in U.S. shipyards and contract out U.S. shipbuilding to their own yards.

Power equipment

In our view, Korean companies are well placed to capitalize on opportunities in the U.S. power equipment sector, including in transformers and in switchgears which aid electrical distribution systems. Power generation could be a key bottleneck for AI infrastructure buildout, exacerbated by aging infrastructure-related upgrade cycles. These factors, combined with high barriers to entry, could provide Korean companies with significant opportunities to increase market share. While Korean power equipment companies may incur tariff charges with power buildout in the U.S., we believe they could be in a position to pass charges along because of capacity constraints.

The AI opportunity

South Korea and Taiwan have become the geographical hub for semiconductors and hardware components production, supporting the global AI boom. While Taiwan’s companies specialize in chip foundry, Korean companies have leveraged their expertise and capability in the DRAM market. High Bandwidth Memory (HBM) chips, one of the most advanced types of DRAM, is now essential to the rollout of AI infrastructure, with SK Hynix and Samsung Electronics leading the market in terms of technology and scale. As the graphics processing unit (GPU) chips of Nvidia, the market leader in GPUs for AI, advance, they require much more bandwidth and capacity from HBM chips. The HBM4 model, for example, offers more than double the bandwidth of its predecessor and can be a solution to the bottlenecks in AI performance, highlighting the growing importance of HBM in the AI value chain.

Amid the structural supply shortage in the HBM market, together with its growing strategic importance to global AI buildout, Korean companies in the field are seeing more opportunities to establish customer loyalty, longer-term contracts and greater pricing power. The memory sector has traditionally been highly cyclical and we still expect expansion and contraction in the area. However, over the long term, we believe Korea’s advanced memory chip makers will further build and expand on their solid market positions.

Corporate reforms and domestic politics

Despite Korea’s competitiveness in key global industries, investors in its equity market have for decades faced a structural overhang known as the ‘Korean discount’ which reflects the influence of large corporate stakes and cross-holdings among chaebols—Korea’s family-controlled conglomerates. This dynamic has discouraged efficient capital allocation and often relegated the interests of minority shareholders, contributing to a lag in Korean equity market valuations compared with peers.

However, this negative influence is gradually being addressed through the government’s ‘value up’ program, designed to encourage better capital allocation practices. Though voluntary, the initiative is gaining traction among corporations and investors fueled by frustration over the economic influence of chaebols and the poor performance of domestic companies. The program has received additional support from Korea’s new president, Lee Jae Myung, who was elected in June. In the same month, the KOSPI 5000 Special Committee was formed to accelerate progress in corporate governance and market reforms. ‘Value up’ has also been enhanced with legislative amendments to the Commercial Act that include expanding directors' fiduciary duties to include all shareholders not just company stakeholders.

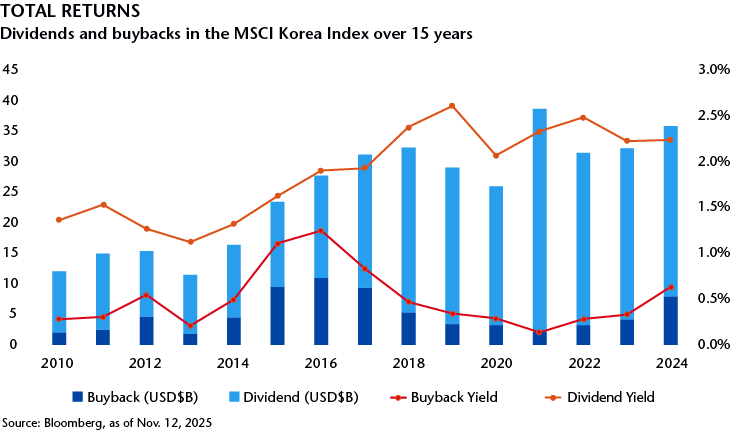

We view Korea’s corporate governance reforms as a key driver in supporting investment returns in the market. We believe the impact of these reforms in generating value in the form of buybacks, dividends and in mitigating the impact of chaebol cross-holdings, will only increase as more changes are introduced.

Korea’s political landscape is also entering a more stable and supportive era, in our view, after a recent tumultuous period. In 2024, market confidence and returns were impacted by the former president’s brief martial-law declaration and subsequent removal from office. While President Lee’s tenure is still in its early days, his administration has shown pragmatism and a willingness to engage with businesses and the market. This has been demonstrated with recent negotiations over potential reforms to the dividend tax regime. The new government appears committed to supporting the expansion of a diverse economy and reforming the stock market to provide more equal access for all stakeholders, and this is generating positive investor sentiment.

Conclusion

At the fundamentals level, Korean equities generally remain attractively priced despite the market’s significant outperformance in 2025 and given its underlying earnings growth potential. Earnings for 2026 for the MSCI Korea Index are estimated to grow by 30% compared to 15% for the MSCI AC Asia Pacific Index, while valuations are at 10.8 times earnings for the Korean market, compared with 15.4 times for the Asia Pacific market.

Overall, we believe the structural strengths of the Korean economy, including a highly skilled workforce and a well-established manufacturing and industrial capability, combined with the opportunities of AI and other evolving technologies, provide a solid roadmap for long-term investment returns. We view the market as offering a robust and evolving set of opportunities that require deep awareness of the intersection of company fundamentals and global industry dynamics, along with a disciplined approach to valuation.

Source: 1Bloomberg. KOSPI Index as of Dec. 15, 2025.

Note: As of Nov. 30, 2025, portfolios managed by Matthews held positions in SK Hynix and Samsung Electronics. As of Nov. 30, 2025, portfolios managed by Matthews did not hold positions in Nvidia.