Staying the Course: Matthews Pacific Tiger

Our portfolio managers field some tough questions on Pacific Tiger’s performance, its positioning and what they believe are its unique strengths for investors.

Overview

Sean Taylor, Chief Investment Officer (CIO) designate

To begin with, it’s worth reflecting on the role Asia plays in the global economy and in our portfolios. It is the growth engine of the world. It is a massive supply chain area with innovation and consumer markets and it is increasingly important as a trade area itself. Above all, Asia continues to grow and its emerging markets are projected to grow faster than any other region in the coming years.

The last five years, particularly the last year, have been challenging. COVID and the different speeds that economies recovered stability has led to different cycles. In Asia, the private sector has taken the brunt of the pain, with job losses and a slowdown in activity absent the government support we saw in the U.S. and Europe. At the macro level, the Federal Reserve’s interest rate hikes and the strong U.S. dollar have also been headwinds. Within Asia, the Chinese economy has faced the biggest challenges, enduring regulatory interventions, a deep property slump, financing concerns and a slower than expected recovery from COVID. And when China slows, others slow. Thailand, for example, depends on China for tourism and trade while Indonesia and Australia are big exporters of commodities to China.

“Asia has a lot to play for, in our view. It has markets which are industrializing and creating capital and there are places like India that are digitalizing on a rapid scale.”

In spite of these challenges we’ve seen robust growth and good returns in some Asian markets. India has done incredibly well this year. Elsewhere, parts of South Korea and Taiwan have performed strongly; in the case of South Korea, from its rapid expansion in the global electric-vehicle (EV) battery ecosystem; in the case of Taiwan, from its embedded role in hardware supply chains and growing positioning in the nascent artificial intelligence (AI) boom.

We believe Asia has a lot to play for. It has markets which are industrializing and creating capital like Vietnam and Indonesia and it has places like India that are moving from consumer staples to consumer discretionary and are digitalizing on a rapid scale. Asia has markets with high growth and markets like South Korea and Japan with low growth that play crucial roles in global technology supply chains. And when China’s growth picks up that will not only be good for China it should have a cascading effect across its Asian trading partners.

Why Matthews Pacific Tiger?

Inbok Song and Sharat Shroff, Lead Portfolio Managers

The strategy has underperformed its benchmark in recent years. Why is this?

In 2023, stock selection in China has been the primary driver of negative returns for the portfolio. Late last year we made a decision to go overweight on China, a decision predicated on our view that economic fundamentals were improving, regulatory risk was receding and valuations still reflected a myriad of concerns. While these assumptions have proven to be right, there has been a softer-than-expected recovery and geopolitical risks have remained elevated. This has caused increased negative sentiment toward China and for some companies it has meant that while earnings have been exceeding expectations their valuations has become progressively cheaper.

If we look back further, what have been the challenges?

Over the past three-to-five years, our underweight to Taiwan and information technology (IT) has had a negative impact on performance. In India, while we have achieved positive stock selection over time, lofty valuations have made it challenging to increase country weight more meaningfully. Our underweight in financials has also been a headwind over the past five years while in South Korea and Southeast Asian countries, stock selection has weighed on performance.

In terms of positioning what would you say has worked and what hasn’t?

Though our allocations weighed on relative returns, our holdings in financials, IT, India and Taiwan contributed positively on an absolute basis over the past three-to-five years. China, South Korea, some Southeast Asian countries and the consumer discretionary, communication services and industrials sectors have detracted from performance on an absolute basis.

Our consumer discretionary holdings in China were particularly challenged against a backdrop of elevated regulatory risk, lower-than-expected consumption recovery and increased competition post COVID. In South Korea, holdings in long duration stocks were impacted by sensitivity to the macro variables like interest rates.

More generally, our strategy of anchoring on valuation with longer gestation periods and holding early-stage development stocks with near-term execution uncertainty has not been additive to returns—the market had a greater appreciation for stocks with clear earnings delivery and high visibility of operations.

Can you explain some of your positioning today?

In India, we are positioned more heavily in consumer and industrial stocks where we believe more long-term opportunities lie but this has contributed to some recent relative underperformance because of our lack of exposure to energy, steel and other commodities. The portfolio has no exposure to these areas as we believe these segments offer more short-term value opportunities and can also be more intrinsically volatile. We’re also slightly underweight in India, mindful of valuation concerns particularly in the mid-to-small cap sectors.

In South Korea, we have an underweight position but in some individual companies we are overweight where we have high conviction. In real estate we are overweight. We have exposure to Southeast Asia-based shopping mall operators which are benefiting from domestic consumption and regional tourism recovery, and we have holdings in home transaction platforms and real estate service providers in China. We are maintaining our conviction of being overweight consumer discretionary in China as we see a strong recovery in e-commerce and local service companies.

Where do you expect an improvement in performance?

We have made changes to the portfolio informed by our research platforms. Within China we continue to diversify to capture economic recovery across different opportunity sets. One of these is medical devices where China has gained global competitiveness especially with expanding its export base. In the strategy we have always sought opportunities that arise from the formation of new markets which are often at the intersection of technology and rising income levels.

Beyond China, we see potential in long-term secular drivers such as productivity gains and innovations in the IT sector. While there are concerns over global demand, we are positioning selectively in companies that can benefit from the strategic capital allocation that we believe will continue from companies around the world. In India, there are several sub-sectors we are gaining exposure to, and we are able to navigate some of the rich valuations for clients by using our fundamentals-based, stock-picking approach to identify clear earnings delivery potential. More generally, we are assessing mispricing opportunities across the market cap range.

Why should investors stay invested?

First of all, it’s hard to overestimate the case for making a dedicated allocation to Asia. It’s a region that is projected have a bigger gross domestic product (GDP) than Europe and the U.S. combined by 2050, and Asian emerging markets are forecast to grow faster than any other region in 2024. Asia is the world’s manufacturing hub and its markets are leading the way in renewable technology. It also has growing consumer markets where discretionary spend is on the rise. Asia could also be a diversifier from a portfolio standpoint. It offers diversification from other regions such as the U.S. and it also offers differentiation across markets within itself.

Secondly, the Matthews Pacific Tiger strategy is one of the oldest Asian ex Japan mutual fund strategies. It has a long-term record based on an investment philosophy which is time-tested across macro and geopolitical cycles. In 2024, we believe the strategy will gain from an economic pickup in China. In addition, the tech sectors in South Korea and Taiwan are looking more interesting as we believe U.S. corporate investment in long-term strategic development will remain and this could provide a source of demand for these markets. We also have a balanced and diversified exposure to domestically-driven companies in growth markets like India, Indonesia and Vietnam.

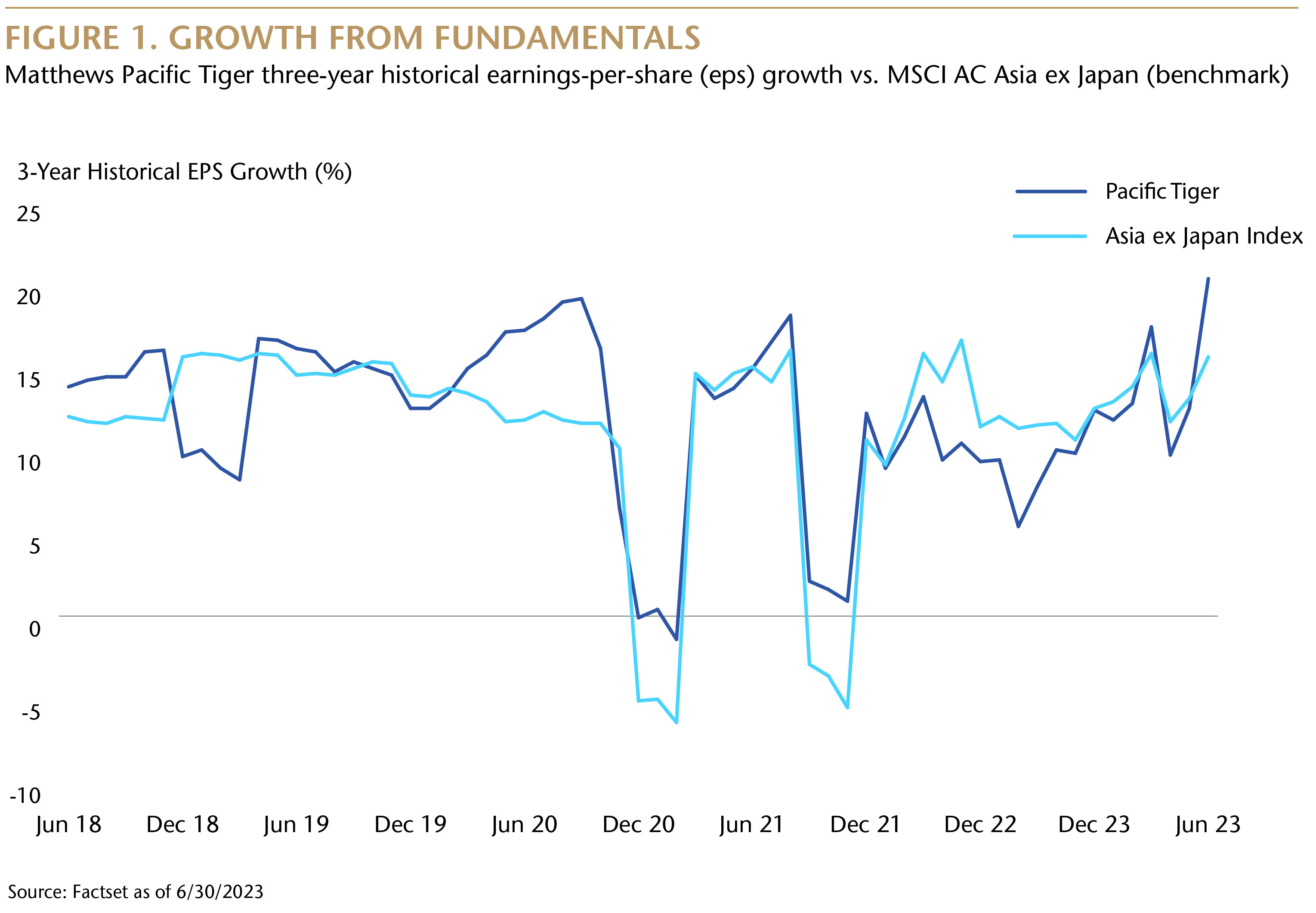

Finally, the Matthews Pacific Tiger Fund has always focused on companies that have quality, are well managed and have a good earnings potential, and are reasonably valued. That has served us well across the region and we believe it will continue to do so.

Why Matthews?Matthews has invested in emerging markets for more than 30 years. This has informed our disciplined investment process which places equal emphasis on risk management and growth opportunities. Our strong risk management over time has improved the durability of outperformance and limited downside risk. We focus on deep company analysis which leads to unique insights and a differentiated portfolio and this focus is across cycles as long-term business owners. We believe earnings growth, valuation and sentiment are what drives markets and within this framework we seek to identify the best bottom-up stock opportunities and ideas that we believe will likely outperform in the current market environment. The Pacific Tiger strategy is in many ways the embodiment of what Matthews brings to emerging markets, offering expertise across a range of markets and on-the-ground company insight, all underpinned by a robust bottom-up stock picking and risk-management process. |