Emerging Japan

Kathlyn Collins, Head of Responsible Investment and Stewardship, says a renewed purpose among regulators and pressure from investors is yielding breakthroughs in the governance and the capital efficiency of Japan’s-listed companies.

SubscribeKey takeaways

- There’s a new sense of purpose emerging among Japanese regulators and a focus on ensuring the standing of Japan’s financial markets are preserved and enhanced into the future.

- On-the-ground pressure from asset managers is yielding improvements in board diversity and environmental oversight.

- Japan's capital efficiency reforms are a potential game-changer. Investors can not only position themselves for earnings-related returns but also for returns generated from increased buybacks and dividends.

Whatever the familiar views are of Japan it’s fair to say things are being shaken up a little. I recently attended a bunch of corporate governance events across Tokyo and there was a real buzz in the air. Japan’s equity markets have performed well this year, its economy seems to be turning a corner and its corporates are in good health. From the meetings I got a real sense of optimism and purpose.

As part of the Japan Working Group of the Asian Corporate Governance Association (ACGA), a nonprofit focused on improving corporate governance in Asia, I crisscrossed the capital meeting investors, companies and regulators, including the Ministry of Economy, Trade and Industry (METI), the Financial Services Agency (FSA), the Japanese Institute of Certified Public Accountants (JICPA) and the Tokyo Stock Exchange (TSE). I also met with the Japan Stewardship Forum, a group of institutional investors engaged in stewardship activities in Japan, and attended the Principles for Responsible Investment (PRI) conference. While I was in town the Government also held ‘Japan Weeks’, a forum for foreign investors and asset management firms where it presented policies aimed at showcasing Japan’s attractiveness as a global financial hub. It all contributed to a whirlwind of energy and I came away with the impression that a new Japan seems to be emerging.

Kathlyn Collins, Head of Responsible Investment and Stewardship, attends the Principles for Responsible Investment (PRI) in Person conference in Tokyo.

Renewed Purpose

The general fervor at the events I attended in Tokyo seemed, in my view, to have been stoked by the government’s edict earlier this year calling on Japanese firms to improve their capital efficiency—a characteristic of Japanese-listed companies that has been long been criticized. Over the past 10 years, corporate Japan’s cash on the balance sheet has ballooned more than five-fold underpinned by strong earnings, however, companies have tended to hold onto this cash and valuations have slumped.

“The general fervor at the events I attended seemed, in my view, to have been stoked by the government’s edict earlier this year calling on Japanese firms to improve their capital efficiency.”

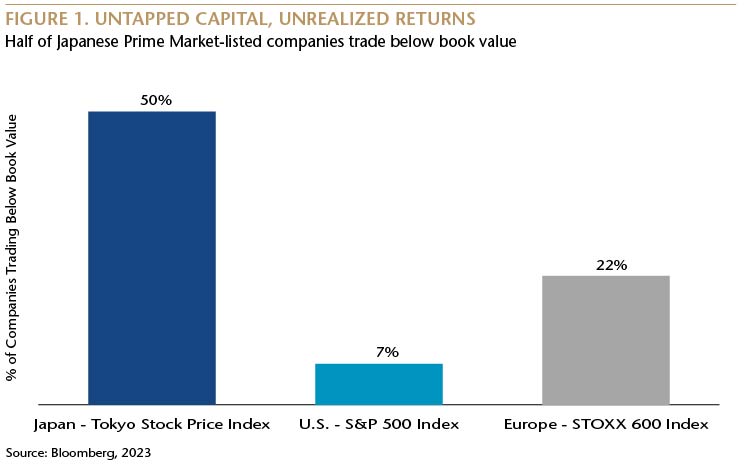

The result, according to the TSE, is that half the number of Japanese ‘prime’ listings—the most liquid stocks with the largest market capitalization—and about 60% of Japanese ‘standard’ listings have a return on equity (ROE) of less than 8% and are trading at price-to-book (P/B) ratios of less than one. A P/B ratio of less than one is generally considered as indicative of a company not using its capital efficiently.

In March, the government instructed listed firms to review and improve capital efficiency, as measured by ROE and return on invested capital (ROIC), take ‘action to implement management that is conscious of cost of capital and stock price,’ and focus on achieving sustainable growth and increasing corporate value over the mid-to-long-term. Companies trading below a P/B ratio of one were told to ‘comply or explain’ or face the prospect of being named and shamed.

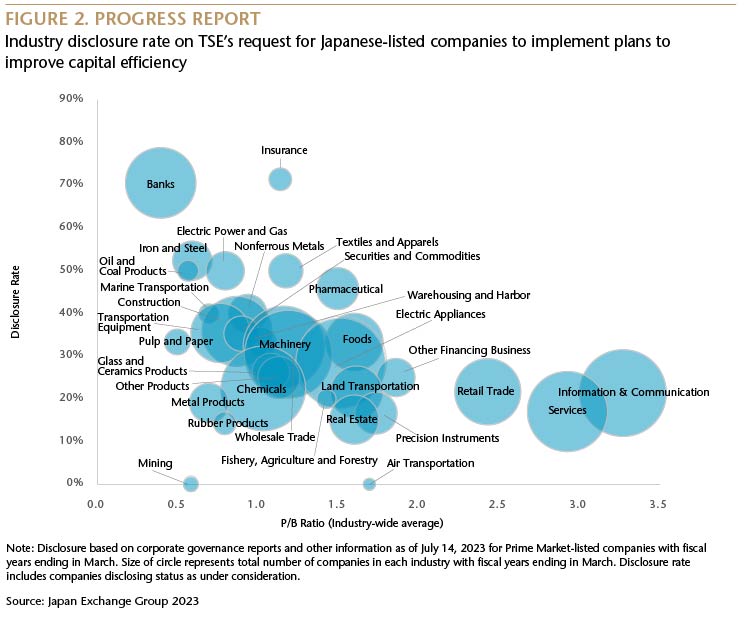

The response was remarkable. The volume of share repurchases hit a peak in May and by the end of August, almost a third of Prime Market companies had disclosed some information related to their cost of capital. Disclosure varied across industries. Disclosure was lower in information and communications, services and retail trade but these segments have relatively higher P/B ratios. In contrast, disclosure among lower P/B ratio sectors like banks and materials was higher and these stocks have rallied this year.

The FSA also launched an action program focused on management issues, including an awareness of cost of capital, sustainability, the role of independent directors, board committee effectiveness and investor dialogue. It’s also getting around to adding clarity to the Act of Making Important Suggestions rule, especially as it relates to disclosure requirements for shareholders owning more than 5%. ACGA says that rule has stifled stewardship and has been contradictory to the principles in Japan’s Stewardship Code.

Of course, corporate governance is nothing new in Japan. This year’s reforms are part of a broader, multi-year structural overhaul that can trace its genesis to Abenomics—the set of economic policies that former Prime Minister Shinzo Abe launched in the early 2010s aimed at reviving growth and combating the chronic deflation that has plagued Japan since the 1990s.

Seeds of ReformCorporate governance was a key component of the three arrows of Abenomics—monetary easing, fiscal stimulus and structural reform—aimed at reviving economic growth and eliminating entrenched deflation.

Source: Matthews |

Importantly, Japan’s efforts to improve corporate governance should be seen within a broader realm of sustainability development. These developments have spanned issues including gender and diversity, the environment, financial inclusion and equality. For example, last year, we saw continued Environmental, Social and Governance (ESG) momentum. In April 2022, the FSA published a ‘Draft Code of Conduct for ESG Assessment and Data Providers’ and in November 2022 it published and began soliciting opinions on proposed amendments to the Cabinet Office Ordinance on matters to be included in securities reports and securities registration statements.

Governance and Sustainability

Japan’s progress in corporate governance and sustainability has been closely followed by investor groups—that have included Matthews—pushing for reform and continuing dialogue. There is still a lot to do. Board demographics, for example, remain a cause for concern. Many Japanese boards are still dominated by older male inside directors, and directors in general are lacking financial literacy and training. The ratio of women on boards in Japan is also considerably lower than other markets. Based on our own analysis, Tokyo Stock Price Index (TOPIX) companies’ percentage of women directors was just 11.8% in 2022. And while the share of female executives in Japan has been rising there is still a considerable gap between Japan and other G7 and Organization for Economic Cooperation and Development (OECD) countries. In 2022, the percentage of female executives on listed companies in Japan was 15.5%. That compares to 30% on average for OECD countries.

Regulator goals around gender are fairly weak and focus on Prime Market-listed companies but they are moving in the right direction. The government has said all listed companies on the Prime Market should strive to appoint at least one female executive by 2025 and have the ratio of female executives at 30% or more by 2030. Matthews, together with the ACGA and other asset management companies, reached out to the FSA and Japan Exchange Group, operator of the TSE, in September 2022 recommending a series of targets for achieving faster and higher levels of board gender diversity. We also informed the Japanese holdings in our portfolios of our new voting policy for gender diversity which became effective this year. From our research and company visits, we can say many boards have upped the pace in searching for female candidates, and search firms and executive recruitment groups are also raising their game.

Japanese corporates have long been ahead of the curve compared with their peers in other developed markets, in my view, in terms of environmental reporting but their operating environment is challenging given the energy mix at the country level. Renewables are expensive and it is difficult to change upstream companies in the chemical space. Still, the government has made bold pledges. It recently introduced a sustainable aviation fuel (SAF) mandate of 10% by 2030. Targets like these are forcing companies to sell cross-shareholdings to fund investments to meet the goals which should be beneficial in the long-term. The electric vehicle (EV) auto space is a good example with companies unveiling plans for emissions reductions which necessitate large capex programs to put them into practice.

Stewardship Pressure

Since the adoption of Japan’s Corporate Governance Code in 2015 many companies have made good progress, in my view. More listed companies today increasingly recognize the importance of a diversified and accountable board, and of practical and regular dialogue with investors. However, during my meetings I detected an air of concern among regulators that Japan’s status among global investment markets is at risk on a number of fronts, including from an ageing society, a loss of competitiveness across some industries, and an increase in passive investor presence in its equity markets. It seems clear that the authorities feel that if they are inactive in corporate governance, Japan stands to lose huge value and miss the opportunity to enhance the growth of its companies.

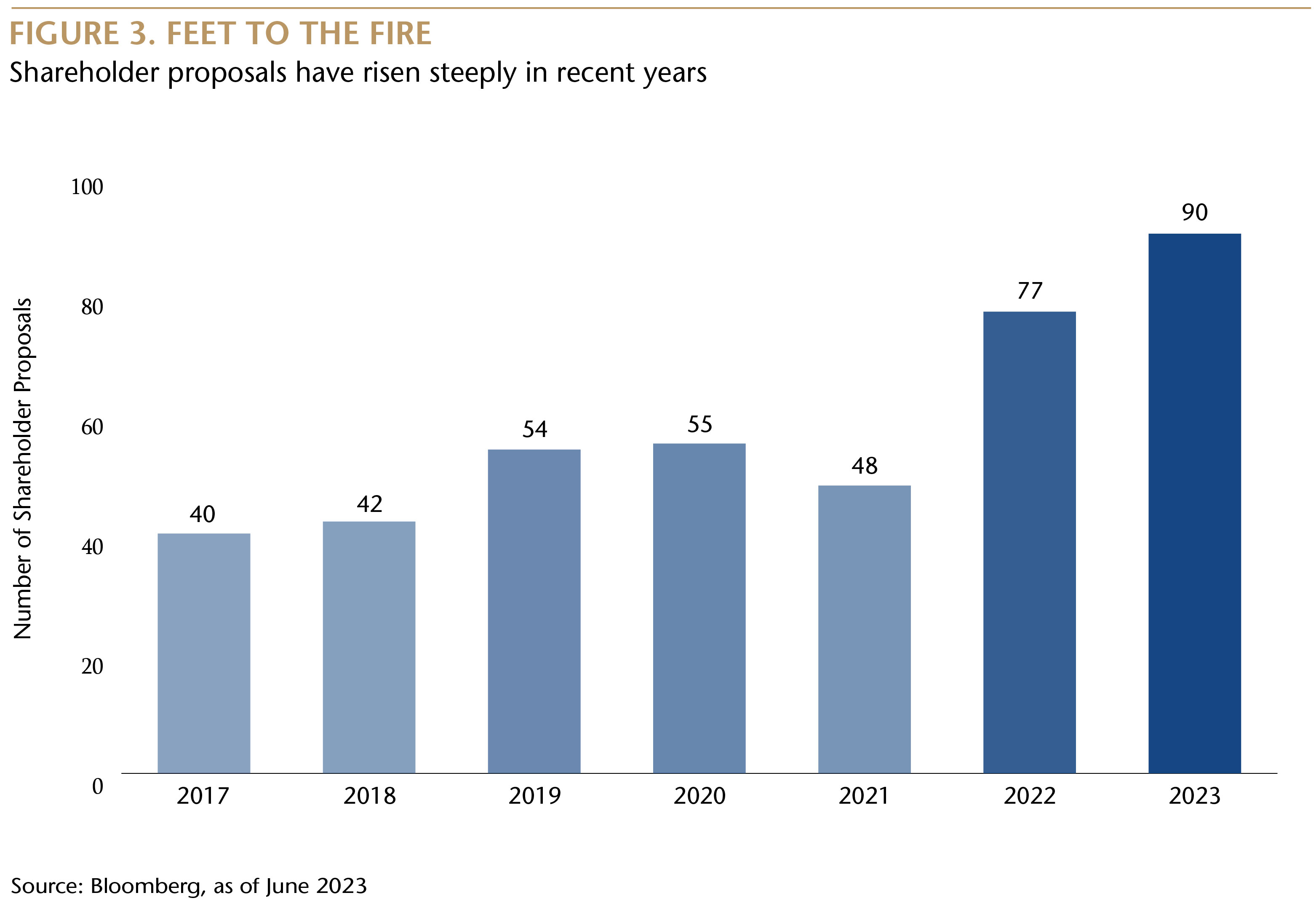

Fortunately, others in the financial community also recognize the challenge. One of the biggest catalysts for change has been the stewardship activity of asset managers. Domestic managers have increasingly put into place more aggressive proxy voting guidelines than even those used by global proxy advisors. Many Japanese asset management companies have added quantifiable standards regarding strategic shareholdings, ROE and board diversity in their voting guidelines. As a result they have started to vote against more company proposals than in the past. This is encouraging. Higher bars and stricter voting guidelines will keep the pressure on and arguably be a more effective agent of change on the ground than regulator intervention.

Activist investors have also exerted their influence in specific areas. For example, they have pushed for fairer guidelines for corporate takeovers as the number of merger and acquisition (M&A) transactions involving Japanese companies has been on the rise yet the bids themselves are much less competitive than in markets like the U.S. and the U.K. On this topic, the government has also responded with guidelines focused on corporate value, shareholder intent and transparency for tender offers.

Old Japan

Old Japan lingers on in many areas. The biggest issues remain ineffective outside directors, cross-shareholdings, conflicts of interest and gender diversity. Cross shareholdings remain a huge issue. Friendly shareholdings are still extremely high and companies often feel the need to negotiate with partners before disposing of such shares. While companies have started to shed shares in allegiant companies, progress is slow and some companies are also shifting the classification of such holdings to where less disclosure is required.

This year’s capital efficiency reforms are to be applauded but they are no magic bullet. Do those companies with a P/B ratio of one or more have an incentive to make further improvements? And why focus on the P/B ratio in the first place instead of, say, price-to-earnings (P/E)? It simply comes down to P/B ratio being easier to understand for most Japanese companies, in my view.

But let’s keep things in context. This year alone, Japan has come a long way. Japan for many investors is exciting again. 2023 may well be a year that saw some key pieces fall into place: like the return of inflationary growth and meaningful corporate governance reform. Work still needs to be done and we will be keeping tabs, keeping the pressure on and pushing for progress with other investors. But these may prove to be key planks as Japan seeks to preserve and improve its global financial profile.

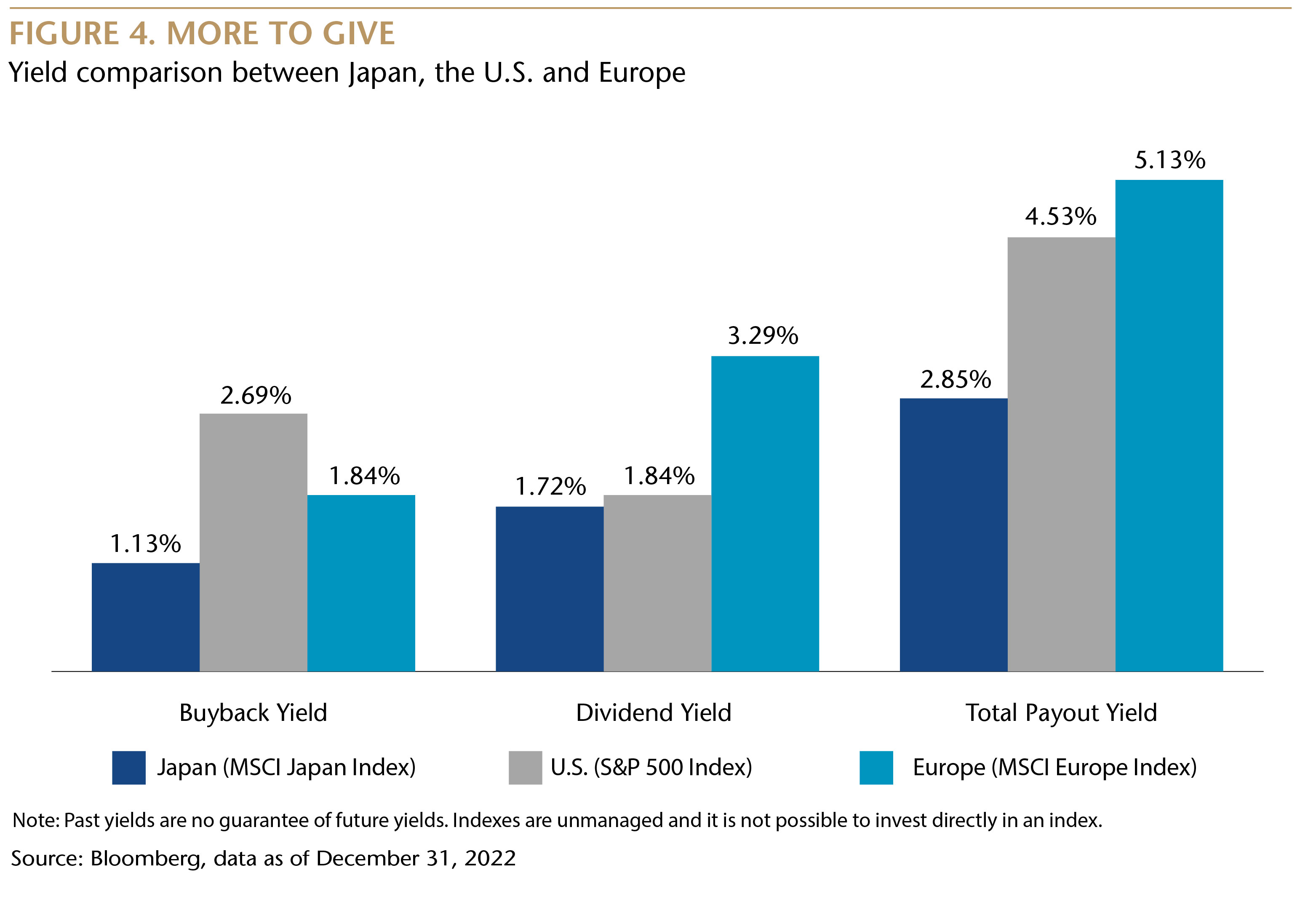

The Investment Case: Portfolio manager Shuntaro TakeuchiThe government’s call for greater capital efficiency among listed Japanese companies is, in our view, a game changer. The reforms need to keep in motion but we believe that they are a development that has significantly boosted the potential upside of total return profiles of Japanese companies. Japan equities trade at a substantial discount in P/B ratio valuations compared to their U.S. and European peers which is primarily due to the accumulation of cash on corporate balance sheets. The Japanese equity total buyback yield is also lower than in the U.S. and Europe. The Japanese equity dividend yield plus buyback yield is around 3% whereas in the U.S. and Europe it is roughly around 5%, (see chart below). As Japanese public companies work to improve capital efficiency and ROE we will see more stock buybacks and higher dividend yields. This should ultimately lead to equity multiple expansion which has been absent over the past 15 years for Japan. |

Kathlyn Collins

Head of Responsible Investment and Stewardship

Matthews Asia

Shuntaro Takeuchi

Portfolio Manager

Matthews Asia

Definitions:

Price-to-book (P/B) ratio: is used to compare a stock's market value to its book value. It is calculated by dividing the current closing price of a stock by the latest book value per share.

Return on equity (ROE): a gauge of financial performance calculated by dividing net income by shareholders' equity.

Return on invested capital (ROIC): measures a company's efficiency in allocating capital to profitable investments, calculated by dividing net operating profit after tax by invested capital.

STOXX Europe 600: index with 600 stocks representing large-, mid- and small-cap companies from 17 countries in Europe: Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland and the U.K.